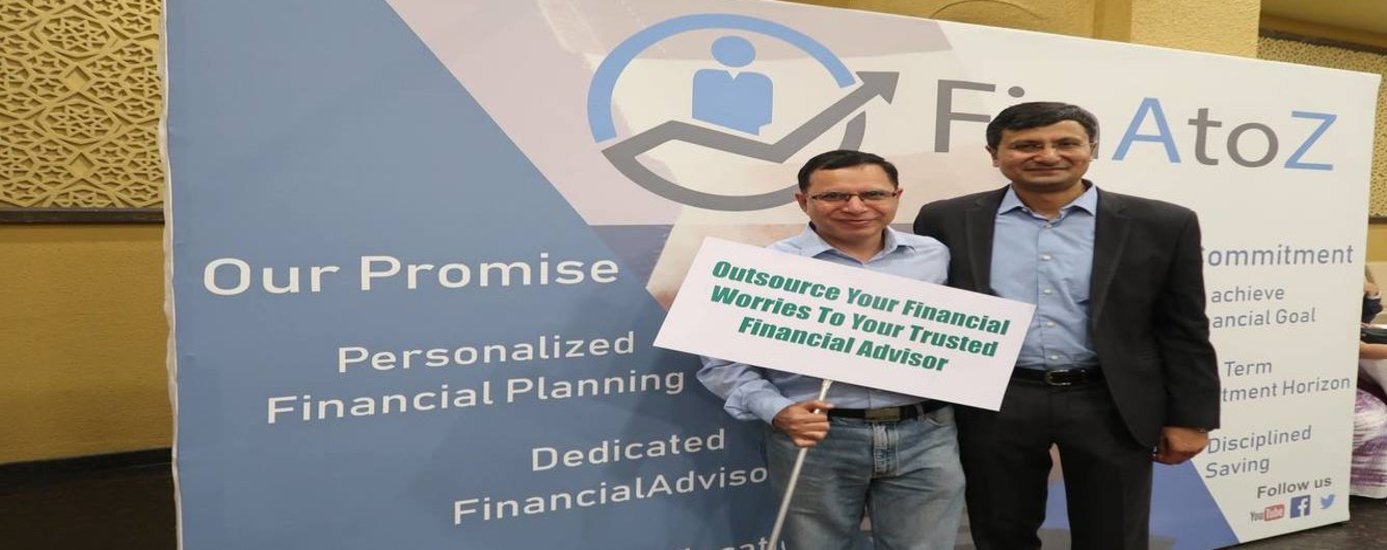

Live Webinar on How to Invest for your Financial Goals by Shailendra kumar,Co-founder FinAtoZ

FinAtoZ is a SEBI Registered Investment Advisory company, started by IIT & IIM graduates who left their respective jobs after 15 years in IT industry with the sole purpose of reducing mis-selling of financial products.

FinAtoZ is a team of Certified financial advisors (CFP, NISM) who provide unbaised advise to busy working professionals to manage their money better.This results in securing the long-term goals like Retirement and Child higher education.

Watch below what our clients feel about us

Register below for free Webinar- 10th June 2023,11:00 A.M.

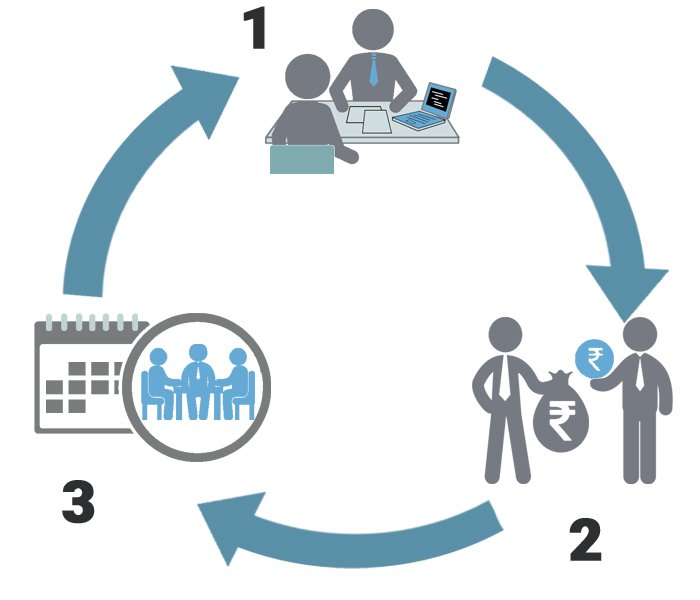

What We Do

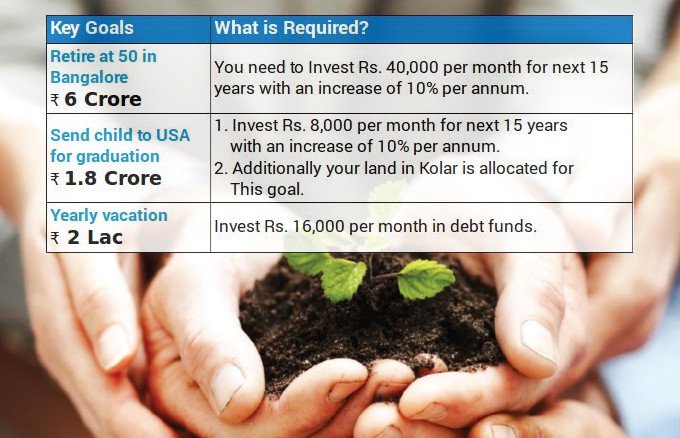

1. Certified adviser to create your personalized financial plan: Your dedicated financial planner will review your current financial situation in a 1-on-1 meeting. The outcome of this meeting is to quantify your financial needs. This will allow you to answer important questions like how much money is enough for your child to realize her dream education (child education plan), and how early can you retire (retirement plan).

2. Highly qualified team to handle your investments as per your risk profile: Our investment team backed by solid research will identify the most suitable financial products for you to achieve your financial goals as per the plan. All these investments are adjusted based on market conditions and available duration for each goal on your behalf.

3. Periodic reviews with your adviser to keep your financial journey on track: During this annual review meeting, your advisor will go through a comprehensive checklist to incorporate any new information in your financial plan e. g. new family member, career changes etc.. Your adviser will also review the investment journey during the year and suggest appropriate remedial actions to ensure successful accomplishment of your goals.

We plan for your goals, Invest in right products, and track them based on market conditions to achieve your goals

Plan your goals

Goals: We spend time to understand your needs and aspirations and prepare a financial plan to achieve them.

Protect: We help you to prepare yourself if things go wrong financially. We identify what insurance is required to protect yourself and your family.

Asset Allocation: We arrive at the right asset allocation for you based on your risk profile and life stage. We even chalk out a plan for you to move from current to the recommended asset allocation.

Tax & Estate planning: We provide advice on better tax efficient products so that you can invest smartly. We come up with Estate plan for wealth distribution to your future generation.

Invest Smartly

Investment execution based on your identified goals and risk profile.

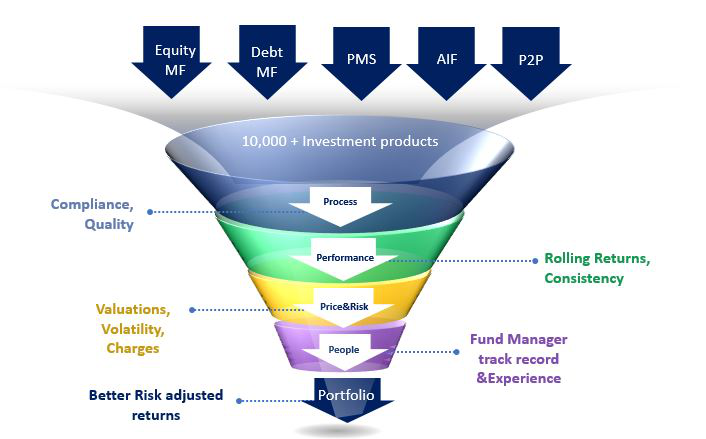

Invest smartly in multiple investment products like Mutual Funds (MFs), Portfolio Management Service (PMS), Peer-to-Peer lending, Structured Real Estate products etc. The selection of these products is done through our comprehensive 5P Research Process.

Rigorous product selection process For each of the asset class, FinAtoZ research team uses cutting edge tools and rigorous process to identify best investment products suitable for your needs.

Consolidated view Facility to consolidate your existing investments on our online portal.

Track and Re-balance

Continuous tracking of your investments based on:

- performance of investment products in your portfolio.

- prevailing market conditions.

- change in your financial plan during review with your advisor.

- your goals (when a particular goal gets near, increase allocation of debt based instruments for that goal irrespective of market conditions).

What We Don't Do?

- We don't provide any stock tips or trading advice. Please don't interact with anyone claiming to be our representative, and is not using the official email id (with @finatoz.com domain in the email address) or our registered WhatsApp Business account.

- Beware of any unsolicited communication providing you trading advise on our behalf. Any funds transfer must be done to the client's own investment account. We never accept funds directly into our company's account.

Research Process

5P Process for Investment Product Selection

Process

Price

Performance

People

Portfolio

Process

Process

The first 'P' focuses on the process followed by a particular investment product. For instance, there are around 40 mutual fund companies with more than 7000 mutual fund schemes in the market. It is very important to assess if a particular company follows robust process for stock/bond selection. We rank these companies on the basis of the following criteria:

- Consistency: Does a company follow its mandate consistently? For example some companies may take higher exposure to mid cap stocks even for schemes that are classified as large cap. They may do it to chase returns. In the bargain they may expose their customers to higher risk. Similarly, some PMS provider may buy stocks that are going up without any fundamental reason. We filter out such companies. Key Metric: % Large cap; % Mid&Small cap

- Compliance: How much do they comply to SEBI guidelines? Do they follow a practice of tweaking SEBI guidelines? For example, even though SEBI mandates a max. 10% exposure in a particular group, some fund houses may find a work-around to increase the exposure beyond 10%, thereby exposing their investors to unsystematic risk. Key Metric: Max. exposure of a particular group.

- Quality: What is the quality of bonds that they are selecting? Are they taking low credit bonds to chase returns? For example, a debt mutual fund can invest a significant portion in lesser than AA rated bonds that may increase the investment risk significantly. Key Metric: %AA & above paper.

Price

Price

The second 'P' focuses on the price that we are pay for a particular investment product. Just like price is an important factor when we buy any personal product like garments, handset etc., it is important to ensure that we pay a reasonable price for any investment product that we invest in. Following factors enable us to evaluate the fair price of an investment product:

- Margin of safety: When we select a mutual fund or any investment product, one of the most important factor that we look for is the margin of safety. More the price that we pay for an investment product, the lesser the margin of safety. Investing into products which are under-valued ensures that the downside risk is limited and the hard earned money of our investors is not getting subjected to undue risk. Key Metric: Price / Earning Per Share; Price / Book Value.

- Management cost: Each investment product has an underlying management cost associated with it. We ensure that the management costs are justified and in line with the performance of a particular investment product. Key Metric: Expense Ratio.

- Cost of exit: Some investment product charge an exit load if you need to withdraw the investments before the stipulated time. For most of the equity funds the exit load is 1% if redeemed within one year of investments. But some funds put a higher time-frame as well. We ensure that we don't get stuck with an investment product for a long period of time. We should be free to change the investments if a particular product is not performing well. Key Metric: Exit Load

Performance

Performance

The third 'P' focuses on the risk adjusted performance of a particular investment product. Following criteria are considered:

- Past returns: We look at long term performance of a given investment product. We filter out products which are not consistent in their performance and give temporary spikes which is generally unsustainable. We like products that outperform in longer duration which should be at least three years. Key Metric: 3 year return, 5 year return, 10 year return

- Volatility: Since a significant part of the portfolio that we create gets invested in equity and equity related investments, the portfolio gets subjected to market volatility. There are innumerable global and domestic events that are beyond our control. As a result the investment corpus may go up or down based on market volatility. Though we cannot eradicate the market based volatility from our investment portfolio, we can choose the investment products which manage the volatility better than the broader markets. Key Metric: Standard deviation.

- Comparative performance: A key factor under consideration is the comparative performance with the benchmark and peer group of the respective investment product. Key Metric: Sharpe ratio.

People

People

The fourth 'P' focuses on the management pedigree of a particular investment product. High quality management team is one of the most important factor for any investment product to outperform in the long run. There is significant churn in the portfolio management industry and it is very important to keep a track of the changes in the management team of a particular investment product. Following factors are considered:

- Fund manager experience: A well qualified & experienced fund manager who has seen various market cycles is in a much better position to take right investment decisions. She has the wisdom to not get carried away in a bull market and has the courage to buy quality companies in a depressed market Key Metric: Fund manager qualification & experience.

- Peer comparison: A fund manager is good if she can perform better than her peer consistently. Using an advanced research tool named "FE Analytics", we compare the fund manager performance against her peer group. Key Metric: Alpha generated in 3 year and 5 year compared to peer group.

- Upside and downside capture: It is the ability of the fund manager to capture more upside when the markets are at an upswing. At the same time limit the downside when the markets head down. Key Metric: % Upside capture, % Downside capture.

Portfolio

Portfolio

The fifth 'P' focuses on the investment portfolio for a particular risk profile of an investor. The investment portfolio is a mix of various investment products like MFs, PMS, P2P, Real Estate products etc. Following factors are taken into account to design the final investment portfolio:

- Risk profile of an investor: Portfolio creation is based on investor's risk profile. There are three broad categories of investors viz. Aggressive, Moderate and Conservative. Portfolio composition for each category will be different. The investment portfolio is created in such a manner so as to reduce the investment risk with lesser impact on return potential Key Metric: Risk category

- Portfolio composition: The investment portfolio will comprise of various sectors like large caps, mid caps, credit risk, real estate etc. Care has to be taken to create a proper mix so as to reduce the risk with optimum diversification. When choosing multiple investment products, we need to ensure that there is not much overlap in the underlying holdings of such investment products. Key Metric: % of Large vs mid vs small vs sector, % Overlap in the portfolio.

- Return potential: The portfolio has to be created keeping in mind long term return potential based on prevailing market conditions. Eventually, the investment portfolio should deliver higher return for each unit of risk taken. Key Metric: Portfolio sharpe ratio.

Get started with Us

FAQ's

- We employ a scientifically proven risk profiling process to reduce the overall risk in your portfolio.

- Our investment research team have access to advanced research tools like Morningstar to select best performing portfolio for you.

- State-of-the-art goal tracking platform to enable you to track your goals and communicate regularly to your financial advisor.

- Bank grade security to keep your personal data secure.

- They are not accountable for the performance of your portfolio.

- Primarily they are driven by their own sales target hence the product sold to you may not be in your interest.

- People selling these services are generally not a Certified Investment Advisor.

- Strategic Asset Allocation - Based on market cycles. This is done for goals that are more than 3 year away. This ensures that any short term losses are recovered in a period of 3 years.

- Goal based Exit - This is done for goals that are less than 3 years away. For example, if you have a goal to buy a car for 10 Lacs in 2020. We will start moving money into defensive category from 2017 onwards. This ensures that you get Rs. 10 Lacs in 2020 irrespective of market conditions.