Monthly Update - July 2018

The domestic stock indices Sensex & Nifty hit the lifetime high. Sensex reached 37500 level for the first time and NSE Nifty reached a peak of 11300 level. The increased corporate earnings resulted in positive investor sentiments. Also, the rising dollar rates increases the revenues of sectors such as IT and Pharma. This, in turn, results in a chain reaction of growth and positive sentiment in the market. Though the indices hit record highs, it is not reflective of the overall market performance. Unlike the previous rally in Jan 2018, all the investors didn’t make money from this rally.

- Indices touched the record high. However, the upbeat sentiment is reflected only in the top 10-12 companies like TCS, HDFC, Reliance, Kotak Mahindra etc.

- The mid-cap companies have fallen in the last 3 months and small-cap companies value has corrected by 15%.

- The market performance grew positively in the narrowest stock index. Whereas in the wider stock index it barely has grown in the current rally.

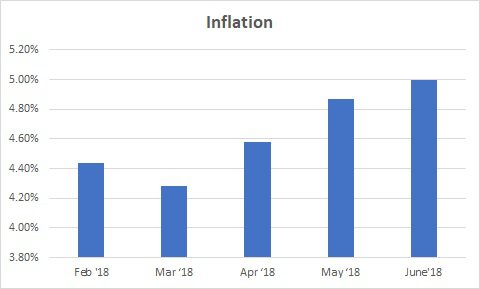

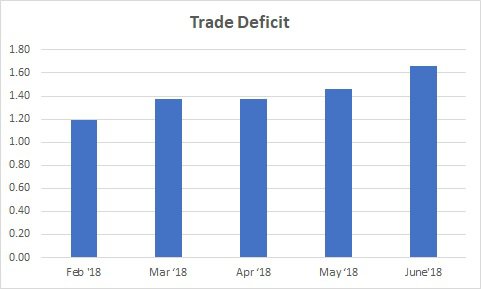

The macro-economic factors are not looking very positive. Rupee has depreciated its value, inflation is increasing and current account deficit is widening. The fall in the rupee and increase in inflation are primarly due to the volatility of global crude oil prices and the trade war between the US and China.

- Trade War - The issues on trade tariffs between the US and China are continuing.

- Oil Import from Iran - India has a pressure from the US to cut the oil imports from Iran. The US has issued an order that all the countries must stop oil imports from Iran. Countries failing to meet this deadline on November 4th shall face the prospect of US sanctions.

- Depreciation of Currency - The above factors lead to a rise in oil prices. It resulted in depreciation of the value of rupee.

- Inflation has increased and it touched 5 months high of 5% last month. It is the highest rate since January.

- All these affected the trade deficit also and resulted in widened current account deficit.

Despite all these negative factors which affect the market adversely, we had some positive factors as well last month.

- The corporate earnings for the April-June quarter were up 20.3% on a YoY basis growing at the fastest pace in the last nine quarters.

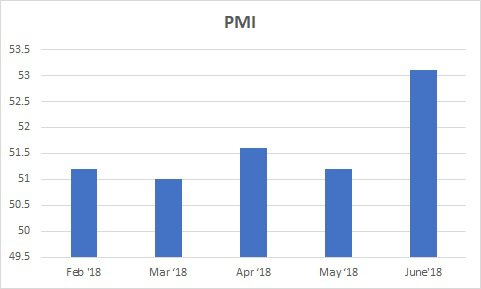

- PMI rose to a six-month high of 53.1 in June which shows the fastest growth of Indian manufacturing economy. It reflects on the production requirements which in turn encourages the purchasing activity and raises staffing level.

Overall market will be volatile with a mix of positive and negative factors. Even though the positive factors push the market up and the negative factors pull the market down.

MACROECONOMIC TRENDS

Kindly refer to the below graphs for a summary of major macroeconomic parameters and their respective trends:

PMI

PMI India rose to a six month high of 53.1 in June 2018 from 51.2 in the preceding month, beating market consensus of 51.4. Both output and new orders increased at the fastest pace so far this year.

INFLATION

Inflation in India has further increased to 5% in June from 4.87% in the previous month and below the market expectations of 5.3%. It is the highest rate since January.

TRADE DEFICIT

The trade gap rose to $16.6 billion in June'18 from $12.96 billion a year earlier. It is the highest trade deficit since May 2013.

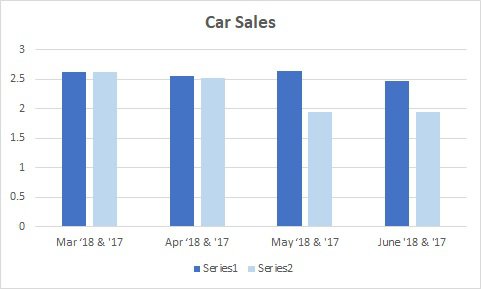

CAR SALES

Car Sales has decreased to 2.47 in June from 2.64 in May. and increased by 27% year-on-year in the month of June.

CORPORATE EARNINGS

Overall the trend for corporate earnings looks to be upward from last few quarters. It is the highest since Q2 16-17

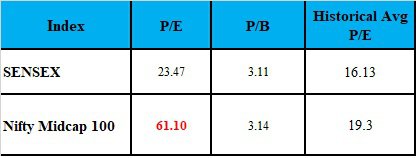

VALUATION

Markets continued to remain overvalued. Large-caps are relatively fairly valued.