Monthly Update - August 2018

Sensex has gained 14% since the beginning of this year and NIFTY has gained 11.2% during the same period. The Corporate Earnings of April - June quarter led to a better performance of firms in FMCG, Information technology and Pharma sectors. But the trade deficit widened to USD 18.02 and rupee value depreciated to 70.65.

We will analyze the market condition by understanding the below factors:

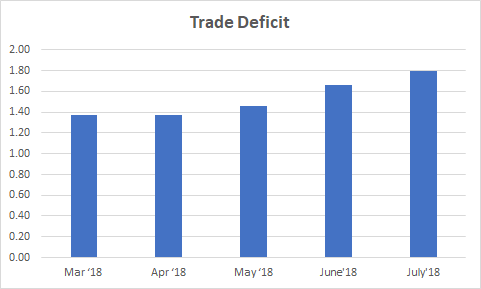

- Trade Deficit

The trade deficit widened to a 5 year high of USD 18.02 billion. The stagnant exports, increasing imports and rising oil prices are affecting the balance of trade and reducing the rupee value. Foreign Direct Investments fell to their lowest since January. The decline in FDI’s impact the balance of trade and rupee value.

- Rupee Value Depreciation

Rupee value depreciated to an all-time low of 70.65 in August. The rupee is expected to continue to depreciate due to several factors like Current Account Deficit, further US Fed rate hikes etc. The widening trade deficit results in weakening rupee as India wants to buy more foreign currencies to meet the increasing imports.

- RBI Interest Rates

Due to this increasing inflation and depreciating rupee value, in 3 months the RBI has raised the interest rate second time by 0.25% and increased it to 6.50%.

- Sensex crossed 38800

Despite all these adverse factors the Sensex crossed 38800 and Nifty crossed 11700 for the first time ever. The US-China trade talks expected to be positive and the increase in buying of Pharma and IT shares boosted the market.

- Pharma and IT Sector

Pharma and IT sectors are showing strength. The fall in rupee results in the growth of Pharma and IT sectors. These sector earn a large part of their revenue in dollars which is favourable for them. We had taken around 10% exposure to Pharma as a sector in our moderate to aggressive portfolios since the beginning of 2018. This is now yielding positive returns and should contribute further in these portfolios going forward.

- Mid and Small Cap Segment

Though the Sensex has run-up this year, mid and small caps have not participated in the rally so far. In-fact both mid and small caps have corrected by more than 10% from the beginning of this year. This divergence in performance provides an opportunity to increase exposure to this segment from a long term perspective. As a result, in our long term moderate to aggressive portfolios, we have recently increased the exposure to mid and small caps for our investors.

- Overall Summary

The market, though a bit overvalued, looks very bullish for the medium to long term perspective. Due to some events like global uncertainty, domestic elections etc, there is a possibility that markets can also correct a bit in the short term. Hence, we are maintaining balanced portfolios across the various risk profiles of our investors. Idea is to gain positively from upward movement of the stock markets. However, in case markers were to correct in the short term, we have sufficient funds in liquid / debt category to make use of such buying opportunity. From a long-term perspective, the Indian markets look very promising at the moment.

MACROECONOMIC TRENDS

Kindly refer to the below graphs for a summary of major macroeconomic parameters and their respective trends:

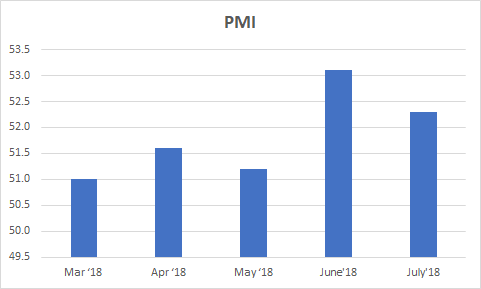

PMI

PMI India dropped to 52.3 in July from a six month high of 53.1 in the preceding month and less than the market consensus of 53.0.

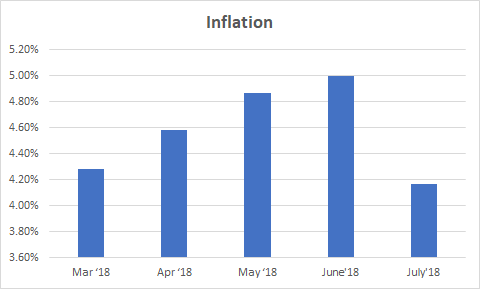

INFLATION

Inflation in India has decreased to 4.17% in July from 5.00% in the previous month and below the market expectations of 4.51%. Still, it is above the central bank's target of 4% for 9 consecutive months.

TRACE DEFICIT

India's trade deficit widened to USD 18.02 billion in July 2018 from USD 11.45 billion in the same month a year earlier. It was the largest trade gap since May 2013.

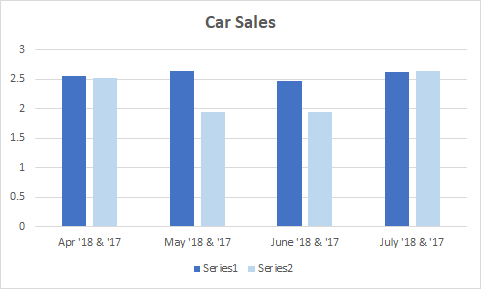

CAR SALES

Car Sales has increased to 2.61 in July from 2.47 in June and decreased by 0.76% year-on-year in the month of July.

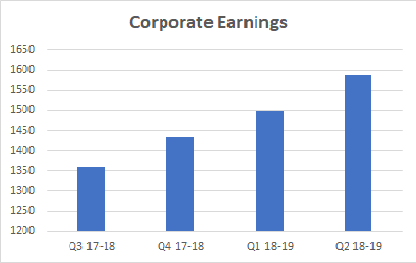

CORPORATE EARNINGS

Overall the trend for corporate earnings looks to be upward from last few quarters. It is the highest since Q2 16-17

VALUATION

Markets continued to remain overvalued from historical P/E basis. However, if we look at other factors like P/BV etc, they look fairly valued.