2019 Budget Analysis

The Union Budget 2019 clearly focused on the middle class, farmers and small traders. It will be an income boost to the middle class and farmers. For the salaried class, the full rebate for the individuals who have income up to 5 lakhs is a step in the right direction. This will have a positive impact on the economy since lower middle class will have more cash to spend for their consumption.

Markets were expecting the fiscal deficit to be at 3.6%. However, there was a positive announcement in the budget that it remains 3.4% of GDP. With the expected fiscal within control, there is some scope for the reserve bank of India to cut the interest rates. So, you can expect your home loan rates to fall somewhat during 2019.

Taxation Highlights of Budget 2019

- Individuals with income up to 5 lacs will not have to pay any tax. Tax rebate raised to income up to rs. 5,00,000.

- Persons with gross income of Rs 6.5 lakh annually will not have to pay any tax after considering investments of Rs 1.5 lakh in tax saving schemes.

- Benefits of rollover of capital gain tax increased from one residential house to 2 houses. It can be up to 2 Cr total once in a lifetime.

- TDS on interest from the bank, post office deposits raised from Rs 10,000 to Rs 40,000.

- Gratuity limit for tax exemption increased from Rs 10 lakh to Rs 20 lakh.

Positive for the consumer-driven economy

Budget 2019 will be an income boost to the middle class, small traders and farmers. The tax relief for middle class and farmers increase their disposable income. This increases the money in the hands of people which increases the consumption and investments significantly. Hence the tax relief for middle class and additional income for farmers is positive for consumption-related business, automobiles, FMCG and Pharma.

Further, volatility is expected to continue in the markets on account of the upcoming elections, movement in rupee and oil prices. Markets may be volatile in the short-term. This gives an opportunity to increase the allocation to equities. Because of the correction during 2018, market valuations look more reasonable at the moment. Some pockets like small caps have become undervalued as compared to their historical averages.

MACROECONOMIC TRENDS

Kindly refer to the below graphs for a summary of major macroeconomic parameters and their respective trends:

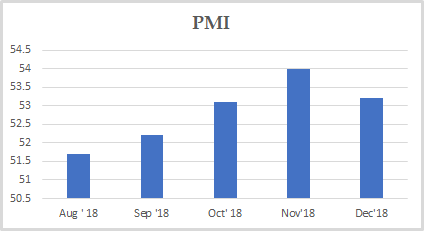

PMI

PMI India reduced to 53.2 in December from 54 in November.

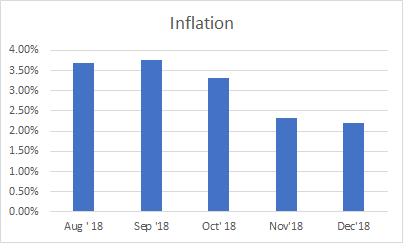

INFLATION

Inflation in India declined to 2.19% in December from 2.33% in the previous month and below the market expectations of 2.2%. It is the lowest inflation rate since June 2017.

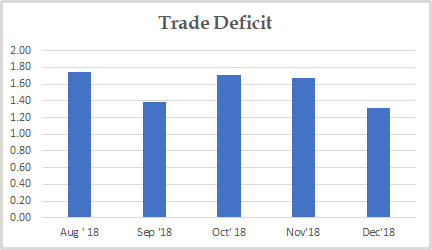

TRADE DEFICIT

India's trade deficit fell to USD 13.08 billion in December from USD 14.2 billion a year earlier.

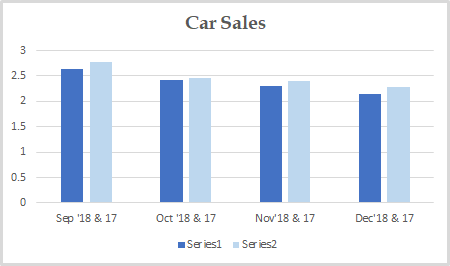

CAR SALES

Car Sales decreased to 2.15 in December from 2.31 in November. It also decreased on a year on year basis by 5%.

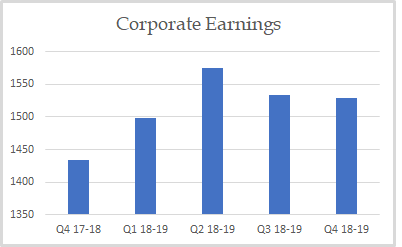

CORPORATE EARNINGS

The corporate earnings are slightly down this month compared to the previous quarter. We need to wait for few more months to ascertain if there is a confirmed change in trend.

VALUATION

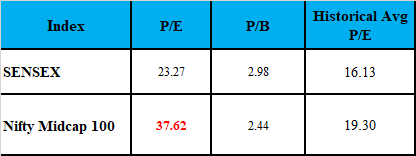

Markets are now looking fairly valued based on historical P/E and P/B basis.