Monthly Update - Sep, 2019

The Indian markets had a rollercoaster ride last month. The markets headed lower during the first half of the month. It staged a sharp recovery on announcement of lowering of the corporate taxes. This could be one of the major turning points of the market in the days to come.

Let us analyse the major events that occurred last month:

Corporate tax cut

On Sep 20th 2019, finance minister Nirmala Sitharaman announced the major corporate tax cut. The government reduced the corporate tax rate to 22% from 30% for existing companies, and to 15% from 25% for new manufacturing companies. After the tax cut, the effective tax rate for all domestic companies has been reduced to 25.17% and for new manufacturing companies at 17.01%. The steepest ever cut of corporate tax improves India’s international competitiveness. The markets are in euphoria after the announcement. Equity indices Sensex and Nifty recorded the biggest intra-day gain in a decade at 4 per cent.

Positives of the tax cut:

- Indian markets will become very competitive as compared to other emerging market economies. This helps to attract higher investments.

- Domestic investors have more cash to undertake more capital expenditure and expansion. Moreover, this helps to reduce their liabilities and strengthen their balance sheet.

- Rate cuts can reduce the import bill. The suppliers can set-up a manufacturing base in India instead of import.

- Reductions in cost can be passed to the end customers.

REPO Rate cut by 25 bps to 5.15%

The Reserve Bank of India reduced the repo rate by 25 basis points to revive economic growth. The repo rate is 5.15% now which is the lowest since March 2010. This is the fifth rate cut in 2019. The corporate tax cut announced by the government a few weeks back would have boosted the Indian markets, further rate cuts will make it more attractive.

US Market begins declining

The US markets started declining caused by US-China trade tensions. Furthermore, US plans 10 per cent tariffs on European aircraft, 25 per cent of other goods. The correction in US stock market leads FPI flows into emerging markets such as India with relatively better growth prospects. With the recent corporate rate cuts and the recent roll-back of enhanced surcharge on capital gains made by FPIs, Indian markets are more competitive. This helps to boost sentiment towards the Indian equity market.

All these factors will help to boost the economy in the long term. However, due to global market sentiments, markets may continue to be volatile in the near term. If we check the past history of Sensex, there are lots of ups and downs in the market over the short term, but in the long-term, the market has given consistently good returns. So be patient, invest for the long term with proper financial planning and asset allocation.

MACROECONOMIC TRENDS

Kindly refer to the below graphs for a summary of major macroeconomic parameters and their respective trends:

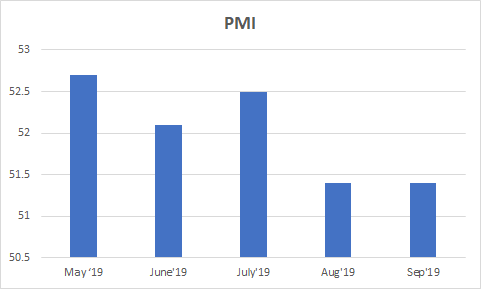

PMI

PMI India was at 51.4 in September 2019 as well unchanged from the previous month.

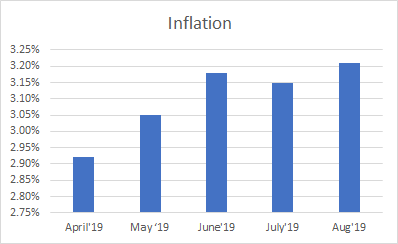

INFLATION

Inflation in India slightly increased to 3.21% in August from 3.15% in the previous month and below market expectations of 3.30%.

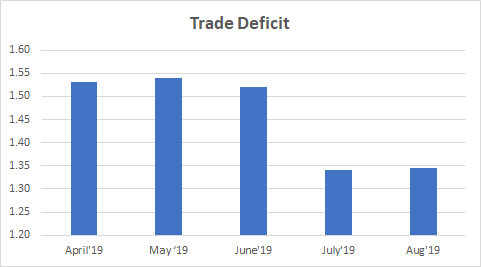

TRADE DEFICIT

India's trade gap narrowed to USD 13.45 billion in August 2019 from USD 17.92 billion a year earlier and below market expectations of USD 13.60 billion.

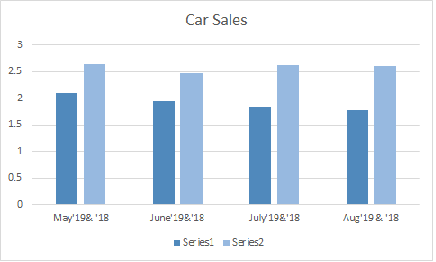

CAR SALES

Car Sales in India plunged by 32% on a year on year basis. It is the fifth consecutive month of sales falling more than 20%.

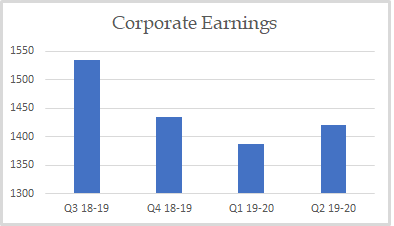

CORPORATE EARNINGS

The corporate earnings are showing a negative trend for the last three quarters:

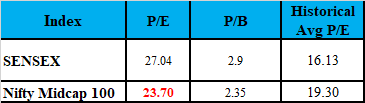

VALUATION

Markets are fairly valued on the basis of historical P/E basis. However, it is undervalued on historical P/B basis.