QUARTERLY UPDATE JAN-MAR 2025

Sun Tzu's timeless wisdom, "In the midst of chaos, there is also opportunity," encourages us to recognize that periods of change and uncertainty can be fertile ground for growth and innovation, if approached strategically.

As the Indian markets find their footing, it's an opportune moment to pause and draw inspiration from the wisdom of legendary investors and thinkers. This is also a time to reassess the strategies and decisions we've embraced as investors. Once again, market corrections have tested our emotions and biases, reminding us of the challenges of staying objective. Amidst the chaos and unpredictability, it's crucial to highlight the silver linings that motivate and shape our investment journeys. Let's delve into the positives driving informed and resilient investment choices.

The financial year 2025 brought notable changes and milestones. A new income tax bill was introduced, foreign institutional investor outflows hit unprecedented levels, and India saw its largest-ever IPO with Hyundai Motor India. Additionally, Narendra Modi achieved a third term in office, while Donald Trump's re-election brought new tariff policies that heightened global uncertainty. Amid these events, the NSE Nifty 50 Index, which had reached record highs during the fiscal year, experienced a nearly 12% drop following its peak on September 27, 2024.

Markets and Indices:

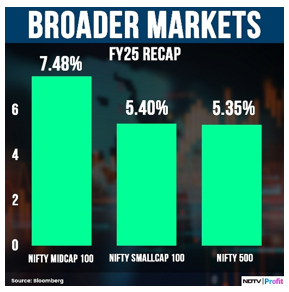

The midcap index outpaced the Nifty 50's 5.6% returns with an impressive growth of 7.48%. In comparison, the broader market index, NSE Nifty 500, along with the smallcap index, delivered slightly lower performance than the benchmark.

Source: "NDTV"

What’s happening with the Rupee?

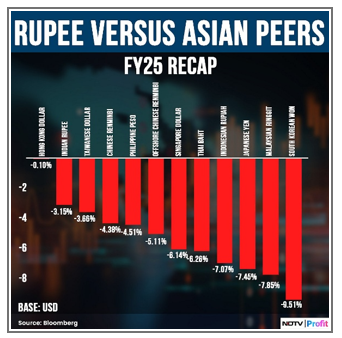

The rupee ranked as the second-best performing Asian currency this fiscal, despite depreciating by 3.15% against the US Dollar. The top performer was the Hong Kong Dollar, though all Asian currencies recorded declines relative to the greenback.

Source: "NDTV"

Inflation and Economic Trends

- CPI inflation moderated to a 7-month low of 3.6% in February 2025.

- Core inflation crossed 4% for the first time in 14 months, reaching 4.08%.

- Industrial growth strengthened, with IIP (Index of Industrial Production) expanding by 5.0% in January 2025, led by manufacturing and mining. The growth was driven by:

- Manufacturing sector: 5.5% growth

- Mining sector: 4.4% growth

- Primary goods: 5.5% growth

- Consumer Durables (long-term consumption goods): 7.2% growth

- Intermediate goods: 5.23% growth

- RBI expected to implement at least 75 basis points of rate cuts in 2025, with successive reductions anticipated in April and August.

- Corporate performance remains strong, with revenue, EBITDA, and PAT growth of 6.2%, 11%, and 12%, respectively, in Q3FY25.

**The above are the major findings of the SBI Ecowrap report, published by the State Bank of India's Economic Research Department

Global factors are playing a significant role in shaping Indian markets in 2025. Here's a snapshot:

- Rising US bond yields and a strengthening US dollar shifted investor focus toward safer assets in developed markets. This has led to capital outflows from emerging markets, including India, causing fluctuations in the rupee's value against the dollar.

- Geopolitical Tensions: Ongoing conflicts in Europe and trade uncertainties due to President Trump's tariffs have impacted investor confidence globally.

- Crude Oil Prices: As a major importer of crude oil, India is sensitive to price fluctuations. While prices have moderated, volatility in the global energy market continues to pose risks.

- Foreign Portfolio Investments (FPIs): FPIs have shown cautious sentiment amid global uncertainties. However, recent positive economic indicators in India have led to a rebound in FPI inflows.

- Global Economic Slowdown: Sectors like IT and pharmaceuticals, which rely heavily on global markets, are facing earnings pressures due to the slowdown.

These factors highlight the interconnectedness of Indian markets with global dynamics.

While the challenges are evident, there are positive aspects for Indian markets that emerge from these global factors:

- Attractive Valuations: Market corrections driven by global uncertainties present buying opportunities in high-quality stocks, especially for long-term investors.

- Resilience in Domestic Consumption: Despite external pressures, India's domestic demand remains robust, supporting sectors like FMCG, retail, and infrastructure.

- Rebound in FPI Inflows: Positive economic indicators in India, coupled with easing inflation, have started drawing foreign portfolio investors back, boosting market sentiment.

- Diversification Opportunities: The slowdown in sectors like IT and pharmaceuticals encourages diversification into industries that benefit from domestic growth and stability.

- Strengthening Economic Policies: Policymakers can leverage global uncertainties to reinforce India's position as an attractive investment destination through favorable regulations and reforms.

- Limited Impact of US Reciprocal Tariffs: India is experiencing a relatively limited impact from the US tariffs compared to other nations. Despite having the highest tariff differential of 9% with the US among major countries, the reciprocal tariffs are expected to affect only 1.1% of India's GDP. This is because India's exports to the US in the most vulnerable sectors, such as electrical machinery, gems and jewelry, and pharmaceuticals, constitute a small portion of its overall GDP.

- Additionally, India's trade surplus with the US, which reached $37 billion in 2024, provides some cushioning against targeted tariffs. The overall impact on India is projected to be less severe compared to countries like Mexico, Canada, and China.

Indian investors can focus on these silver linings to navigate the complexities of interconnected markets and identify opportunities amidst challenges.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment