Difference between Absolute and Annualised Returns

As an adviser, we have been receiving many queries related to returns. Many of our clients get confused between Absolute returns and Annualised returns.

While Absolute return is very easy to understand, most of the financial instruments (including Fixed Deposits) report the returns as Annualised returns. What is the difference between the two? Why does the reporting of returns happen in annualised value. Why it can't be reported in simple absolute value?

Lets try to understand the difference first:

Absolute Return

An absolute return measures an investment’s performance without regard to the total duration of the investment time.

Annualized Return

An annualized return measures an investment’s performance on a yearly basis.

The difference between absolute and annualized return can be explained with few examples given below-

Example #1 - One time investment in Fixed Deposit

Suppose an investor makes a one time investment of Rs. 10 Lakh in Fixed Deposit. This investment becomes 12 Lakhs over a period of three years.

Absolute return= 100*(12-10)/10 = 20%

Annualized return= (12/10)^(1/3)-1 = 6.3%

In this example, though the investments grew by 20% in absolute terms which sounds great, it gave a measly return of just 6.3% on a yearly basis! Or in other words, the investment grew by 6.3% in Year 1, 6.3% in Year 2 and 6.3% in Year 3.

Above example shows that returns in FD does not even beat inflation. We go one step further to say that investments in Fixed Deposits may be in-fact risky. Read our blog on Risk of investing in FD.

Example #2 - One time investment in Real Estate

Suppose an investor makes a one time investment of Rs. 50 Lakh in a piece of land. This investment becomes 1 Crore over a period of eight years.

Absolute return= 100*(100-50)/50 = 100%

Annualized return= (100/50)^(1/8)-1 = 9.1%

Now 100% absolute returns on a real estate investment looks fantastic!! Anyone who has got such returns will boast about it in his/her social circles with a lot of pride. However, proper way of reporting this return is in an annualised manner. If we take that approach, we see that annualised returns are 9.1% which are not as great as it looked at the first instance!

Lot of people have the misconception that investment in Real Estate is the best option because they might consider absolute returns at the time of sale. They should calculate annualised returns to get the real picture.

Though the returns in real estate might be somewhat higher than the inflation, there are several other risks that are related to investments in Real Estate. For further understanding you can read our blog on Risk of Investing in Real Estate.

Example #3 - Periodic investment in a Mutual Fund

It 's a bit difficult to calculate annualised return of a monthly recurring installment. This is because each investment does not get invested for the entire year.

Ex- Suppose one is planning to invest Rs. 12 Lakhs in a year and is making a monthly investment of Rs. 1 Lakh every month. The person finds out that after one year the investment has grown to 12.8 Lakhs.

In this example, the absolute returns will be calculated as follows:

Absolute return= 100*(12.8-12)/12 = 6.67%

The investor may get disappointed to see just a 6.67% absolute return. However, this is not the correct representation of return. This is because the investor has not invested entire 12 lakhs for the entire year. He has invested only 1 Lakh for the entire year. Similarly, he has invested 1 Lakh for only 11 months. Another 1 Lakh for just 10 months....and so on.

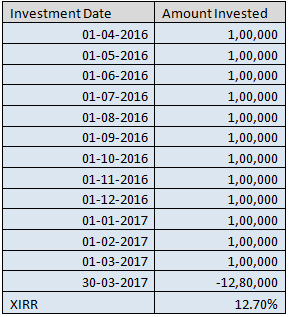

Now the question is how to calculate the annualised return to get the correct picture? For this, there is a simple method available in MS Excel. We can use XIRR function in MS excel to calculate the annualised returns:

XIRR Calculation in Ms-Excel- XIRR(Amount Invested,Investment Date)

If one calculates return from above method, one can observe that the annualised returns are significantly higher than the absolute returns in the above example.

Conclusion: - Each product manufacturer will show you numbers in the way they look attractive to them to sell it to you. But in our experience, annualized returns are the most effective way to calculate the returns and compare different products. In fact, if you are interested you should also look at how to calculate the rolling annualized returns. Rolling returns can be used to get deeper insights into the returns.