Ways to earn tax-efficient income from your retirement corpus

While most of us are comfortable saving a small amount on a monthly basis, but generally we find it difficult to handle the lump sum money. Such a scenario mostly happens to us at the time of our own retirement or, we see it happen to our parents when they retire. After putting in long years of service, when we get our Gratuity, EPF and paid leave encashments amounting to few lakhs or even more than 1 crore, we have limited know-how as to how to invest it for our peaceful retirement. To invest such a large sum of money can be a challenge for us and needs careful planning based on individual needs and evaluation of various investment options available in the market.

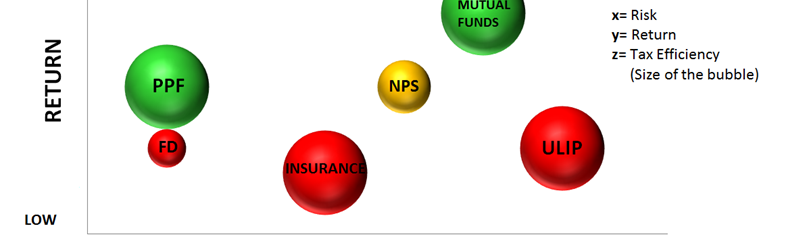

In this article, we will discuss the ways, in which one should construct the portfolio using the available investment options for investing her retirement corpus. Broadly, there are three types of products available in the market to invest your retirement corpus. While each of these products has their own unique benefits, but to get the best risk-adjusted returns, we recommend to take an appropriate mix of these products. The three type of products are listed below:-

1) Government-backed products with guaranteed but low taxable returns

Recommended for people till their total income falls into taxable bracket. Not recommended to go beyond 2.5lakh interest as it is taxable. (Ex:- SCSS, POMS and Govt Bonds)

a. Senior Citizen Savings Scheme {Interest rate of 8.2% pa}

There is a limit on the amount that can be invested. An individual can only invest up to Rs 30 lakh. The interest paid gets added to your income and is taxed at your marginal tax rate. Also, the tax deductible at source is deducted if the interest exceeds Rs 50,000 per annum. This scheme allows you to withdraw prematurely, but after levying a charge of 1.5% of the deposit if you draw after one year and 1% after two years. You are also entitled to a tax deduction at the time of investment, and the interest rate remains unchanged for its five-year tenure.

b. Post Office Monthly Income Scheme {Interest rate of 7.4% pa}

This scheme does not give any tax deduction benefits, and only up to 9 lakh can be invested individually and Rs 15 lakh in a joint account. Premature withdrawal of money is allowed but at a charge of 1.5% if you withdraw after one year but before two years and 1% if you draw after two years.

c. Government of India(GOI) Savings Bond {Interest Rate of 6.31% pa}

There is no limit on the amount of investment. You can buy it from nationalised banks, some private sector banks such as HDFC, ICICI bank and offices of the stock holding corporation. You can buy them anytime but these bonds are not listed, so you can’t exit by selling them on the secondary market. These bonds are taxed at your marginal rate of interest. The principal amount is locked for 6 years for customers aged 60-70, 5 years for customers aged 70-80 and 4 years for customers aged 80 and above. However, you have an option to get the interest payment every six months.

2) Secure investments with around 8% returns

Recommended for that portion of money which needs to be kept risk-free and not beyond that. Ex:- SWP in debt mutual funds.

a. Systematic Withdrawal Plans (SWP) of debt funds

A regular income can be generated through SWP in a debt fund. SWP in higher duration funds or those having high credit risk should be avoided. An ultra short-term debt fund where the duration is low and credit quality is high will be a better pick.

To know more about taxation of debt mutual fund click Debt Mutual Funds Taxation

3) Risky investments with returns around 12%

Recommended for that portion of money which needs to be kept for beating inflation. Ex:- Equity funds.

a. Equity Funds

You need to take some amount of risk in your retirement corpus and invest the surplus amount in equity funds like large-cap diversified and multi-cap funds to eliminate the inflation risk. This will benefit you in the long term with 12-15%(approx) returns. A small portion of your corpus, 20-30% should be invested in growth assets like equity funds to get inflation-adjusted returns.

To know more about taxation of equity mutual funds Equity Mutual Funds Taxation

Retirement planning is to be done by choosing the right mix of investments in these three instruments based on an individual needs. Also, it is advisable to maintain Emergency Funds and Health Funds (which is 3 months of expense each in cash).This can be achieved by using the careful selection of debt mutual funds.

For any help do contact a professional financial advisor to help you with the selection of a suitable mix of these products and associated tracking. Hope this helps you to construct a good portfolio which fulfils your requirement of low volatility and enough returns to have a peaceful and enjoyable retirement.

Happy Investing!