Gold ETFs vs Physical Gold: Which One for You?

Gold has always been a trusted investment for Indian households. But today, investors have smarter ways to invest in gold without physically storing it. You can choose between Gold ETFs or Physical Gold. Each option offers different benefits depending on your goals and risk tolerance. In this blog, we’ll simplify the comparison of gold ETFs and physical gold so you can decide which gold investment option suits your financial needs best.

Sovereign Gold Bonds (SGBs) are now discontinued. However, investors can consider the following alternatives:

Gold ETFs

Exchange-traded funds that track gold prices. They enable easy buying and selling through a demat account, eliminating storage concerns.

Gold Mutual Funds

These funds invest in gold ETFs and are suitable for investors without a demat account.

Digital Gold

Available through select platforms. It lets you buy and store small amounts of gold.

Physical Gold

Coins, bars, and jewellery purchased through jewellers or banks. Subject to making charges and GST.

Gold Savings Schemes

Offered by jewellers to help customers accumulate gold gradually for future purchases.

What is a Gold ETF

A gold ETF is an exchange-traded fund that invests in physical gold. Each unit of a Gold ETF represents one gram of 99.5% pure gold.

These funds are traded on stock exchanges just like company shares. Investors do not hold physical gold but own units that track gold prices in real time.

Gold ETFs are managed by fund houses and stored securely with custodians. They provide an easy and transparent way to invest in gold without worrying about purity or storage.

Many investors use a gold ETF bond as a simple, paperless alternative to physical gold. Gold ETFs also help diversify a portfolio and serve as a hedge against inflation or currency fluctuations.

How Does a Gold ETF Work

Gold ETFs are managed by fund houses and backed by physical gold stored in secure vaults. Investors buy units of these funds instead of holding physical gold.

Each unit represents a fixed quantity of gold and reflects real-time market prices. The value of a Gold ETF moves in line with gold prices.

If gold prices rise, the ETF value also increases. Investors can easily buy or sell these units on the stock exchange, ensuring high liquidity.

ETFs are more flexible for short-term trading, making them ideal for investors who prefer quick entry and exit without dealing with storage or purity concerns.

Advantages of Investing in Gold ETF

Investing in Gold ETFs offers several practical benefits compared to physical gold. Here are the key advantages:

- High Liquidity: Gold ETFs can be bought or sold easily on the stock exchange during trading hours, ensuring quick access to funds when needed.

- Guaranteed Purity: Each unit of a Gold ETF represents 99.5% pure gold, removing concerns about quality or making charges.

- Transparency: Prices are publicly available on exchanges, allowing investors to track gold value in real time.

- Low Storage Risk: ETFs are held digitally, eliminating storage and security issues associated with physical gold.

- Tax Efficiency: Investors pay only capital gains tax, avoiding wealth tax or VAT.

- Ease of Trading: Transactions are simple, with no entry or exit loads.

- Ideal for Short-Term Investors: ETFs offer greater flexibility for frequent traders seeking quick returns.

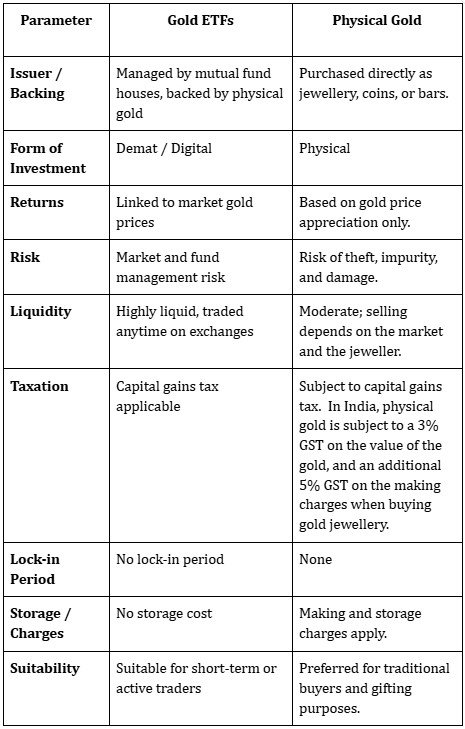

Gold ETFs vs Physical Gold

How FinAtoZ can Help

FinAtoZ is a SEBI-registered financial advisory platform that helps investors build a clear and goal-based financial plan. Every client is guided by a certified adviser who reviews their economic situation through one-on-one discussions. This helps identify key goals, such as funding a child’s education or planning for early retirement.

The expert investment team designs portfolios aligned with each investor’s risk profile and market conditions. They manage investments across multiple products, including mutual funds, PMS, peer-to-peer lending, and real estate.

Each product is selected using FinAtoZ’s rigorous 4P 1R Research Process. Investors also receive periodic reviews to keep their financial plan updated and on track. With smart investment execution and a consolidated view of all assets, FinAtoZ ensures a seamless wealth management experience. It helps investors make informed decisions about investing in gold bonds, gold ETFs, and other financial avenues.

FAQs

Can I buy Gold ETFs without a Demat account?

No, a Demat account is required to buy and sell Gold ETFs since they are traded electronically on stock exchanges.

Are Gold ETFs safer than physical gold?

Gold ETFs remove risks like theft, storage, and purity concerns. However, they carry market-related risks, as prices fluctuate with gold prices.

Is physical gold better for long-term investment?

Physical gold suits traditional investors who prefer holding assets for gifting or personal use, but making charges and GST can reduce overall returns.

Can Gold ETFs be sold anytime?

Yes. Gold ETFs can be bought and sold during stock market hours, offering greater liquidity than physical gold.

Which option is better for beginners, Gold ETFs or physical gold?

Gold ETFs are usually better for beginners due to transparency, low costs, and ease of trading through a demat account.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment