Comprehensive Guide to Estate Planning

Imagine this.

A well-settled businessman in Mumbai passes away without a proper estate plan. He believed his properties, savings, and business assets would automatically go to his wife and children. Instead, his family spent years in court, struggling through legal procedures, managing inheritance challenges, and fighting emotional conflicts, not because there was no wealth, but because there was no plan.

This right here is the loss of estate meaning in real life: when your assets, time, peace, and intention all get lost in legal complexity.

This is where estate planning comes into play.

Estate Planning Process at a Glance — A Quick Checklist

- List all assets (List all assets (property, such as homes or land; accounts, including savings and current accounts; gold, like locker jewellery; business shares; digital assets, such as cryptocurrency holdings and online investment platforms).

- Select beneficiaries (spouse, children, parents, charity, others).

- Choose key decision-makers: Executor, Trustee, Guardian, POA Agent.

- Create your essential documents: a Will, a Trust, a POA, and Medical Directives.

- Register, notarize, and store documents safely.

- Inform loved ones about where documents are stored.

- Review and update after major life events (marriage, birth, property purchase).

What is Estate Planning, Really?

Estate planning is the process of creating a strategic plan for the management and distribution of your assets after your death or in the event of incapacitation. Estate planning isn’t just about writing a will.

Estate planning means legally managing and preparing the transfer of your assets, like property, money, business, and investments, to your loved ones after you're gone. It also includes making decisions for situations where you’re alive but unable to manage your affairs due to disability, illness, or incapacity.

It ensures:

- The right people receive the right assets at the right time

- Your family avoids legal disputes

- Your wealth is protected, not lost in paperwork, court battles, or unnecessary taxes

In India, estate planning involves documents such as wills, trusts, nomination rights, powers of attorney, and guardianship, all legally valid and permitted under Indian laws such as the Indian Succession Act, 1925, the Hindu Succession Act, 1956, and the Indian Trusts Act, 1882.

Why Estate Planning Matters (Even If You’re Not “Rich”)

Estate planning is not just for the wealthy. It’s for anyone with assets or responsibilities, regardless of income level. Consider a typical scenario: a ₹50-lakh flat and an EPF corpus. These modest assets can still get entangled in legal battles and uncertainties without proper planning:

- Property

- Savings and investments

- Business ownership

- Minor children or dependents

- Digital assets (UPI accounts, online wallets, demat accounts)

Without proper planning, your assets may:

- Get stuck in court for a year, with probate durations of approximately 2 to 5 years in major Indian cities like Mumbai, Delhi, and Bangalore.

- Be divided according to the default law, not your wishes.

- Be taxed unnecessarily or transferred inefficiently.

- Causes disputes among heirs.

That’s why a comprehensive estate plan protects your assets, intentions, and relationships.

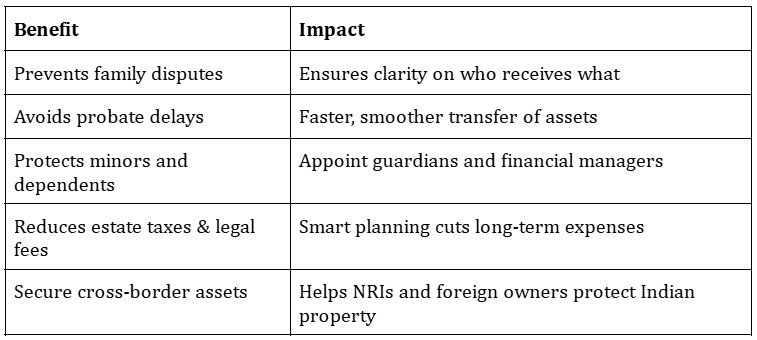

Key Benefits of Estate Planning

India has no estate taxes, inheritance taxes, or death duties, making estate planning even more beneficial. Imagine what you could achieve by reinvesting the money saved from these taxes. How would you choose to grow your wealth or support your loved ones with those extra funds? Thinking about these possibilities might inspire you to take immediate action in securing your estate plan.

Who Governs Estate Planning in India?

According to Indian law:

Hindus, Sikhs, Jains, Buddhists: governed by the Hindu Succession Act

Muslims: governed by Islamic Law of Inheritance (Sharia)

Christians, Parsis, Others: governed by The Indian Succession Act, 1925

Each law has its own rules on how assets are inherited with or without a will, making a written estate plan even more critical.

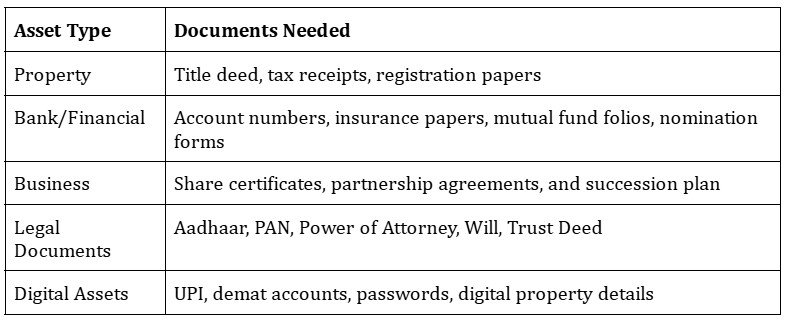

Documentation Required for Estate Planning

To create legally valid estate planning documents, assemble:

The Estate Planning Process in India

(Simplified into 5 life-friendly steps)

Step 1: List What You Own (Your Estate)

Include:

- Real estate (house, flat, land)

- Bank accounts, mutual funds, insurance policies

- Business ownership, company shares, HUF assets

- Cash, gold, digital investments, crypto

Step 2: Identify Your Beneficiaries

Who should inherit your assets?

- Spouse

- Children

- Elderly parents

- Business partners

- Charitable trusts

Also consider who should manage these assets until minors turn 18.

If you’ve recently become a parent, aligning your estate planning with your family’s new financial goals, like those outlined in our ‘New Parents’ planning guide, makes your will and trust far more effective.

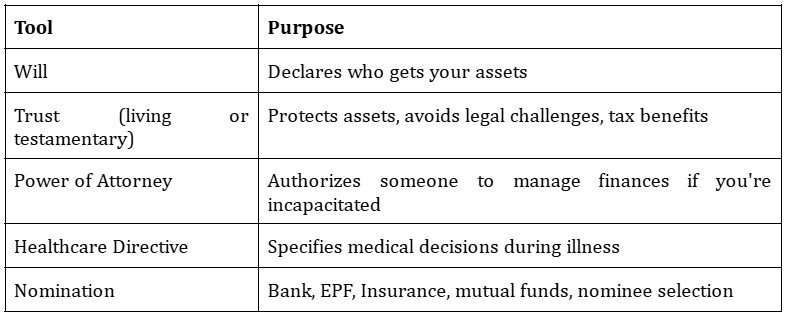

Step 3: Choose the Right Estate Planning Tools

Trusts are extremely popular in India for bypassing probate, protecting business assets, and reducing disputes.

Step 4: Understand Indian Law & Probate

Probate is the legal validation of a will by a court, required mainly in Mumbai, Kolkata, and Chennai. Without proper documentation, asset transfer gets delayed. NRIs and joint family assets (HUF) often require legal clearance for inheritance.

Step 5: Update Your Plan When Life Changes

Life evolves, so should your estate plan.

- Marriage or divorce

- Birth of a child

- Buying a new property

- Starting a business

- Moving abroad (NRI estate planning varies)

How to Write a Will (The Foundation of Estate Planning)

Writing a will doesn’t need to be complicated, but it must be clear, legal, and properly signed.

Here’s a simple breakdown:

- Title: “Last Will and Testament of [Full Name]”

- Personal Details: Name, address, date of birth, PAN, Aadhaar

- List all assets (with clear descriptions — include property papers, locker details, accounts)

- Name beneficiaries and mention exactly what each one receives

- Appoint an Executor — someone you trust to carry out your wishes

- Sign in the presence of two adult witnesses (not beneficiaries)

- Optional: Register with the Sub-Registrar’s office

Tip: Even a handwritten will is valid in India, but it must be clear and legally signed.

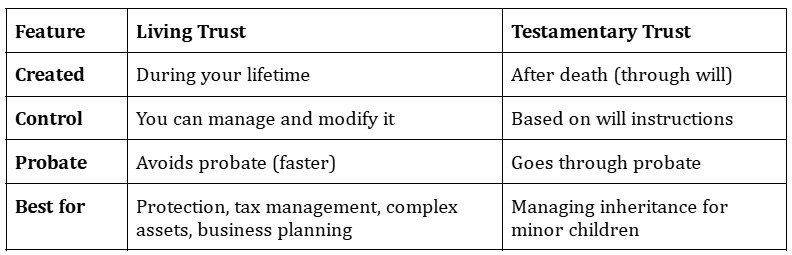

Living Trusts vs. Testamentary Trusts: What’s the Difference?

Estate Planning Mistakes That Cause Family Disputes

- Relying only on nomination (nominations are not a legally enforceable inheritance)

- Not mentioning digital or foreign assets

- Not appointing guardians for minors

- Using outdated or informal wills

- Not signing, witnessing, or registering correctly

Remember: even a handwritten will is valid, but it must follow legal formalities and witness signatures to be enforceable.

Estate Planning in India for NRIs

NRIs owning assets in India can:

- Make a single foreign Will covering Indian property, or

- Create a separate Indian Will for assets in India

NRIs must comply with FEMA regulations when transferring, selling, or repatriating inherited assets (up to $1 million annually).

For NRIs managing both Indian and overseas holdings, it’s useful to understand investment hubs such as GIFT City and how they affect estate structuring. See this detailed guide for NRIs using GIFT City.

Frequently Asked Questions - FAQs

How do I actually start the estate planning process? Should I consult a lawyer, or can I do it myself?

You can start estate planning by listing assets, choosing beneficiaries, and drafting a basic will yourself. However, for complex cases (multiple properties, business ownership, NRI status, trusts), consulting an estate planning lawyer or financial advisor ensures legal validity, clarity, tax efficiency, and protection against disputes.

Where and how should I safely store my estate planning documents, and who should have access to them?

Store original documents (will, trust deed, POA) in a secure, fireproof location, such as a locked file cabinet, bank locker, or digital vault. Share access details only with essential people such as the executor, trustee, spouse, lawyer, or trusted family members. Maintain a digital backup with encrypted passwords for safety.

What are the typical costs involved in making a will or trust in India?

A basic handwritten will costs nothing. A registered will may cost ₹1,000–₹10,000. Professionally drafted wills range from ₹10,000–₹25,000. Trusts are more expensive, ₹25,000 to ₹1.5 lakh+, depending on complexity, legal consultation, and stamp duty. Corporate trustee services can cost additional annual maintenance fees.

How often should I review or update my estate plan, and what triggers a review?

Review your estate plan every 2–3 years or when major life events occur. Trigger events include marriage, divorce, birth or death of a beneficiary, property purchase, business change, inheritance, change in law, or moving abroad. Update wills, nominations, and trustees accordingly.

Are there any special considerations or steps for NRIs beyond what’s mentioned?

NRIs should ensure asset distribution complies with FEMA and RBI repatriation limits, taxation rules in both countries, and with whether to create an India-specific will. They may need notarized or apostilled documents, foreign witnesses, or multiple wills (for different countries) to manage cross-border estates, bank accounts, or inherited property smoothly.

Get Expert Financial Advice

Book an introductory call with our Certified Financial Planner to explore how we can help you achieve your financial goals.

Book Your Appointment