5 Tips to ride Market Volatility for better Returns

Indian stock markets have been quite volatile in the calendar year 2018. If we look at the difference between the peak to the lowest point, Sensex has corrected by 15%, Midcap by 25% and Small-cap by more than 30%. It is quite natural for any investor to get worried when they see the value of their hard-earned money getting eroded. The pain compounds exponentially if the value of the investments becomes lower than the principal amount invested. You may wonder how to protect your capital and what should be done in such a situation.

To understand the investor behaviour better, we have analysed possible reactions from the investors during such situations of market volatility. We found the following common behaviour biases:

Behaviour #1 - Stop fresh investments

This is a state of non-decision. Since, markets seem to be doing bad, investors often decide to stop all running SIPs and new investments into equity products. The principal that is already invested is allowed to remain as-is without taking any action.

Behaviour #2 - Check-out of equity products

This is a panic situation. To save the capital that is invested, investor may decide to completely sell all the investment in equity products. This generally happens if the level of investor knowledge about equity is on a lower side.

Behaviour #3 - Disciplined approach to investments

This behaviour is exhibited by disciplined investors. This breed of investors have a razor sharp focus on their financial goals. They also generally have access to high quality advise professional from their financial advisor. They let their investments continue as per their financial plan despite market volatility.

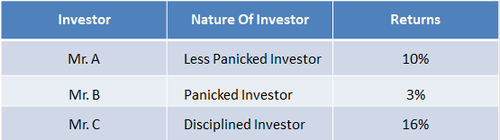

Let us understand the outcome of these behaviour by taking an example of the past. In the scenario, lets go back to a time-period of 2008 when the equity markets were pretty volatile.

Lets say, Mr. A, Mr. B & Mr. C started investments on 1st Jan, 2007 with the same amount. They invested 2 Lacs as a one time investment and Rs 10,000 monthly SIP.

Mr. A got worried when markets went down in 2008 but did not panic completely. He choose to stop all the fresh investment and continue with what he had already invested. He then shifted his SIPs into FDs instead of equity mutual funds.

Mr. B panicked on seeing loss on his investments in 2008. He decided to sell all his investments and invest the proceeds in an FD. He also shifted all his fresh investment into FDs.

Mr. C was a disciplined investor. He did not change his investment pattern and continued to invest in equity products despite the market volatility. All his financial goals were long term (more than 5 years away) and hence there was no need to act on the short term market volatility.

Lets see how these three investors fared at the end of 10 years:

From this example, we can understand that investors who redeem investments during market volatility inherit permanent losses. Whereas, disciplined investor who continue to invest despite the market volatility earn the best returns. They, however, have to ride the temporary market volatility.

Based on our analysis of several such situations in the past, we advocate the following five tips to ride the market volatility. These tips should help you to improve your investment behaviour and generate better returns in the long run:

Tip #1 - Don’t panic

If you panic when the market goes down, it will certainly force you to make wrong decisions. Any investment decision that gets generated because of panic will never yield expected results.

Tip #2 - Don’t redeem the invested amount

Redeeming the invested money when the markets go down results into permanent loss. Till the time, you don't sell, it is just a virtual loss. The moment you sell, the loss becomes real.

Tip #3 - Don’t stop fresh investments into equity; if possible buy more!

If you stop investments, you will miss a good opportunity to accumulate more units in a falling market. Moreover, later you need to invest more to compensate for the period you are not investing to achieve your financial goal. To give you a parallel, investing in a falling market is almost similar to buying in an online sale. Sale where good quality products are available at a discount to their MRP. In-fact, it makes sense to buy more than the regular SIP when markets fall.

Tip # 4 - Don’t change funds just because of recent under-performance

Don't change funds just because they did not do well since the time markets have started falling. Some of the funds do very well when markets go up. Similarly they may fall more when markets fall. If there was a logical reason to choose such funds earlier, there is no reason to change that decision due to short term under-performance. One should wait slightly longer to see how the fund manager is dealing with the changed situation. However, take a decision to change the fund in case there are other strong reasons like change of fund manager etc.

Tip #5 - Refrain from making changes to the portfolio without any professional help

Seek the help of your professional financial advisor if you want to modify your investment portfolio. Portfolio creation is a very skilled job. You will certainly do well to consult a professional. After-all it is about preserving and growing your hard-earned money!