Secure Your Family's Well-Being With Right Health Insurance

In a world of uncertainties, one aspect of life remains constant: our health. The promise of medical advancements and the prospect of a longer, healthier life is tantalizing, but they come hand in hand with a complex web of challenges. Welcome to the realm of health insurance – a vital tool in ensuring not only our physical well-being but also our financial security.

The healthcare landscape of today is a blend of astonishing medical breakthroughs and sobering realities. While cutting-edge treatments and technologies offer hope for curing diseases that were once deemed impossible, the financial burden associated with these advances has become an elephant in the room. Skyrocketing medical costs have left countless individuals struggle with the harsh choice between their well-being and their wallet.

Health insurance is important for several reasons:

- Financial Protection: Medical treatments can be expensive, and a serious illness or injury can lead to significant financial burden. Health insurance helps cover these costs, reducing the impact on your savings and overall financial stability.

- Access to Quality Healthcare: With health insurance, you can afford to seek timely medical care without worrying about the cost. This encourages early detection and treatment of illnesses, leading to better health outcomes.

- Preventive Care: Many plans offer coverage for preventive services like vaccinations, screenings, and annual check-ups. These preventive measures can help catch potential health issues early, preventing more severe conditions in the long run.

- Choice of Hospitals and Doctors: Depending on the policy, health insurance may give you access to a network of hospitals and doctors. This ensures that you can choose healthcare providers based on your preferences and needs.

- Emergency Situations: Accidents and medical emergencies can happen unexpectedly. Having health insurance ensures that you're prepared to handle such situations without worrying about the immediate financial impact.

- Coverage for Chronic Conditions: Health insurance can provide coverage for the management and treatment of chronic illnesses, which often require ongoing medical attention and medication.

- Peace of Mind: Knowing that you have health insurance can provide peace of mind, reducing stress and anxiety about potential medical expenses.

- Family Coverage: Many plans offer coverage for family members, safeguarding their health and well-being as well.

- Legal Requirement: In some cases, health insurance might be mandatory as per local laws, such as in certain employment situations or for obtaining certain types of visas.

- Tax Benefits: In many countries, including India, health insurance premiums are eligible for tax deductions, providing an additional financial incentive to have coverage.

In essence, health insurance acts as a safety net that not only protects your finances but also ensures you receive the necessary medical care when you need it most.

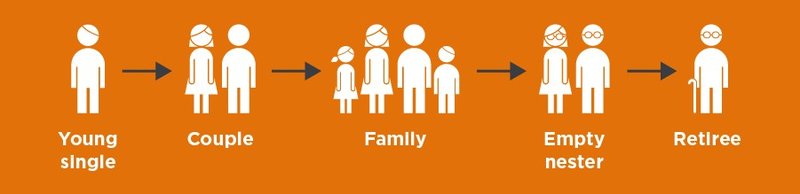

Health Insurance-Different stages

Health insurance is important across different stages of life due to the varying healthcare needs and potential risks that individuals face. Here's how health insurance remains crucial in different life stages:

- Early Adulthood (20s - 30s): During this period, people are generally healthier, but accidents and unexpected health issues can still arise. Health insurance provides financial protection in case of emergencies and covers preventive care to maintain overall well-being.

- Starting a Family (30s - 40s): Pregnancy, childbirth, and childcare expenses can be significant. Health insurance with maternity coverage helps manage these costs. Additionally, coverage for children ensures that their healthcare needs are met from an early age.

- Middle Age (40s - 50s): As people age, the risk of chronic illnesses increases. Health insurance is essential to cover treatments for conditions like diabetes, hypertension, and heart diseases. Regular health check-ups and screenings become more important during this stage.

- Pre-Retirement (50s - early 60s): This phase may come with age-related health concerns and the need for more medical attention. Health insurance ensures that medical expenses don't deplete retirement savings.

- Retirement (60s and beyond): Seniors often require more frequent medical care and prescription medications. Senior citizen plans cater to these needs and provide coverage for age-related health issues.

- Throughout Life: Health insurance provides a safety net for unforeseen accidents or illnesses at any age. It also offers access to a network of healthcare providers and specialized treatments, ensuring timely medical attention.

- Transitioning Jobs or Self-Employment: Health insurance can be particularly important when changing jobs or starting a business, as these transitions might lead to temporary gaps in coverage. Maintaining continuous coverage helps avoid disruptions in healthcare access.

- Family Dependents: Health covers not only the policyholder but also dependent family members. This is crucial for ensuring the health and well-being of children, spouses, and elderly family members.

Health insurance adapts to the changing healthcare needs and risks that individuals face throughout their lives. It provides financial protection, access to medical care, and peace of mind, making it an important aspect of overall well-being at all stages.

Better Way to Choose Your Family’s Health Insurance

Choosing the right health insurance plan for your family's needs requires careful consideration of various factors. Here's a step-by-step guide to help you make an informed decision:

- Assess Your Family's Needs: List the current health needs of each family member, including any ongoing medical conditions, prescriptions, and expected healthcare services.

- Determine Coverage Options: Understand the types of health insurance plans available, such as Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), or High Deductible Health Plan (HDHP) with Health Savings Account (HSA).

- Coverage Essentials: Ensure the plan covers essential services like hospitalization, doctor visits, prescription medications, preventive care, maternity care, and emergency services.

- Network of Providers: Check if your preferred doctors, hospitals, and specialists are in the plan's network to avoid out-of-network costs.

- Coverage Area: If you travel frequently or have family members in different locations, consider whether the plan provides coverage outside your immediate area.

- Premiums vs. Costs: Compare monthly premiums (the amount you pay for the plan) with deductibles (the amount you pay before the plan kicks in) and co-payments/co-insurance (your share of the costs for covered services). Balance your budget with potential out-of-pocket costs.

- Prescription Coverage: If your family relies on specific medications, check if the plan covers those prescriptions and what the costs are.

- Maternity and Family Planning: If you're planning to expand your family, ensure the plan covers maternity care, childbirth, and pediatric care.

- Coverage Limits and Exclusions: Understand any coverage limits, exclusions, or waiting periods for pre-existing condition

- Benefits and Additional Services: Some plans offer additional perks like wellness programs, telemedicine services, mental health coverage, or dental and vision coverage. Assess if these align with your family's needs.

- Financial Assistance and Subsidies: If available, check if you're eligible for government subsidies or employer contributions to help with premium costs.

- Review the Summary of Benefits: Thoroughly read the plan's Summary of Benefits and Coverage to understand what's covered and what's not.

- Customer Reviews and Ratings: Research the insurer's reputation, customer service quality, and reviews from current policyholders.

- Compare Multiple Plans: Obtain quotes and compare multiple plans from different insurers to find the one that best fits your family's needs and budget.

- Consult with an Expert: If needed, seek advice from insurance brokers or financial advisors who specialize in health insurance to get personalized recommendations.

Remember that choosing the right health insurance plan is a significant decision that impacts your family's well-being and financial security. Take your time to research, compare, and carefully consider your options before making a choice.

In conclusion, health insurance is a critical financial tool that provides protection against high healthcare costs. It's essential to choose a plan that aligns with your specific medical needs, budget, and preferences. Understanding the coverage, costs, network, and any additional benefits or limitations is crucial when selecting a plan. Regularly reviewing and updating your coverage as your circumstances change can help ensure you have adequate protection for your healthcare needs. Additionally, seeking advice from insurance professionals or financial advisors can be beneficial in making informed decisions about your health insurance coverage. Remember that health insurance is an investment in your well-being and financial security, providing peace of mind in times of illness or medical emergencies.