How an International mutual fund can add value to your portfolio?

From childhood we are listening, never put all your eggs in a single bucket. We all understand the importance of diversifying our mutual fund portfolio into different equity caps mutual fund and debt mutual fund. Now, let’s see how it make sense to diversify our portfolio geographically with the help of an international mutual fund?

What all are the different options available for diversifying portfolio internationally? and, How are they regulated?

Why should anyone invest in the international fund?

Diversification - In the world of long-term investments, it is well known that many investors suffer from 'Home Bias'. Click here to read more about 'Home Bias'. People suffering from this bias will invest 100% of their money or most of their money in the companies listed in their home country. Even though they see, that there are many multinationals whose products they are using themselves, but are hesitant to invest internationally. Also, there are phases when the Indian economy doesn’t perform well, while some international markets may do well and give good returns. One should critically examine his portfolio and take corrective action to adjust the portfolio with adequate international exposure.

Hedging – Now, a day we are increasingly opting for Child higher education abroad and opt for an international holiday. So, with the help of international funds, one will be able to hedge the currency risk.

Let’s take an example to understand the hedging of currency risk-

Suppose, you are planning to send your child abroad for higher education after 15 years. So, obviously from now onwards you will start investing for him/her, but there will always be a currency risk associated with that investment. Because if you are investing in the Indian market and markets gave the profit of 10% per annum, but what if Rupees depreciates by 5 % then your overall return of that particular investment will come down by 5%. So, a fee of 100K USD today will mean that you need 70Lakhs today in INR terms. But, if Indian rupee depreciates and 1 USD = 140 INR (i.e 5% depreciation in 15yrs), then you need to save nearly 1.4Crs instead of 70Lakhs! But if your investment is in USD for this particular goal, then you are not affected by the rupee depreciation.

Hence, international mutual funds help in hedging the currency risk because these funds invest in US dollars.

Investment Opportunity - These funds also give us the opportunity to invest in world-class companies like- Apple Inc, Amazon, Alphabet, Facebook and Microsoft.

Hence, it makes sense to diversify geographically

Downside related to international mutual fund-

Market risk: Geopolitical and socioeconomic factors in each country or a region can influence fund performance.

Currency risk: Even though your investment is in rupees, the underlying exposure is in foreign currency assets. Fluctuations in the exchange rate can boost or hurt fund returns.

Past performance of International Mutual Funds-

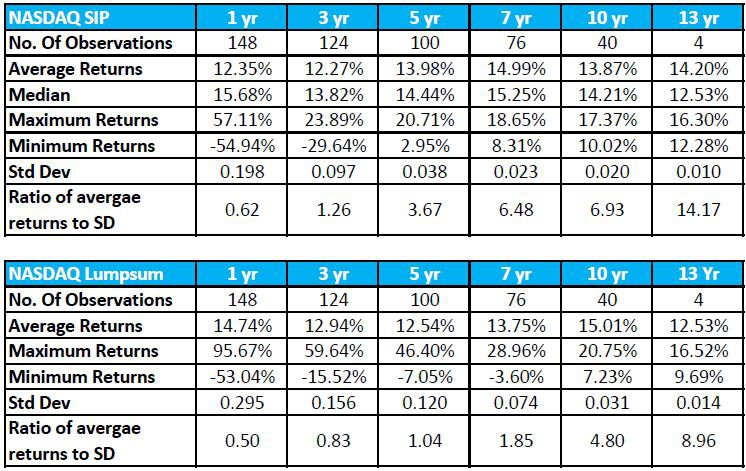

From 2006 to 2019 we have back-tested the data and found the SIP returns as well as Lumpsum returns.

Let’s understand the different attributes of the above-mentioned table:

- No. of observation: We have taken the data from 1st Jan 2006 to 1st March 2019 and found the SIP returns of different tenures. Since for 1 year, the observation will be high and gradually it will decrease by 12 points for every year passed.

- Average Return: On the basis of no. of observation, we found the average returns of different tenures.

- Median: As we all know that mean may not be a fair representation of the data, because of the average, which is easily influenced by outliers (like 2007 and many other), so with the help of mean we will be able to know exact results.

- Maximum Returns: It means in the different time frames, what is the maximum return an investor can earn.

- Minimum returns: It means in the different time frames, what is the minimum return an investor can get.

- Standard Deviation: By how much the returns are deviating from its mean return.

- The ratio of average return to Std Dev: This ratio will tell us about performance of an investment by adjusting for its risk, which how much return we are getting on every unit of taking the risk.

There are few very interesting observations in the above tabulated data:-

- After 5yrs of doing SIP investments, there are no negative returns observed, from the market.

- As the tenure of the investment is increased, the gap between maximum and minimum returns reduces for both SIP and lump sum investments. Moreover, the returns are very predictable after 5 years of investment.

- From the above data, the most important observation is helping us to remove the confusion between one-time lump sum investment or SIP. As per the backtested data, we have found that investing through SIP is preferred because the ratio of average return to Std dev is very high. It means we are getting more reward on per unit of risk. This is however true, only if no other factor is taken into consideration while investing the lump sum money.

Now let’s see, what should be the maximum allocation of international mutual in a Portfolio?

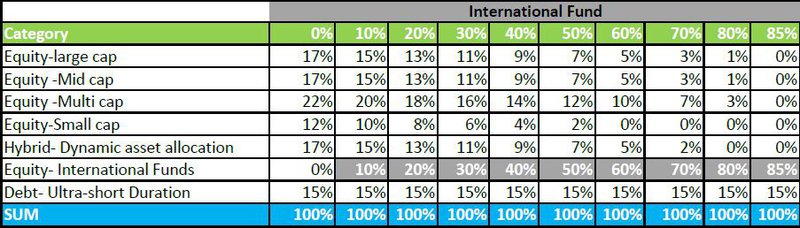

As we have already discussed the best way of investing in an international mutual fund is SIP. Now, let us figure out the maximum allocation of International mutual funds in our portfolio. Is there some optimum percentage allocation to international funds in one's portfolio? Let’s understand this with the help of a real-time example-

We have considered a portfolio with different Mutual Fund classes and gradually increased the allocation of international mutual fund in the Portfolio.

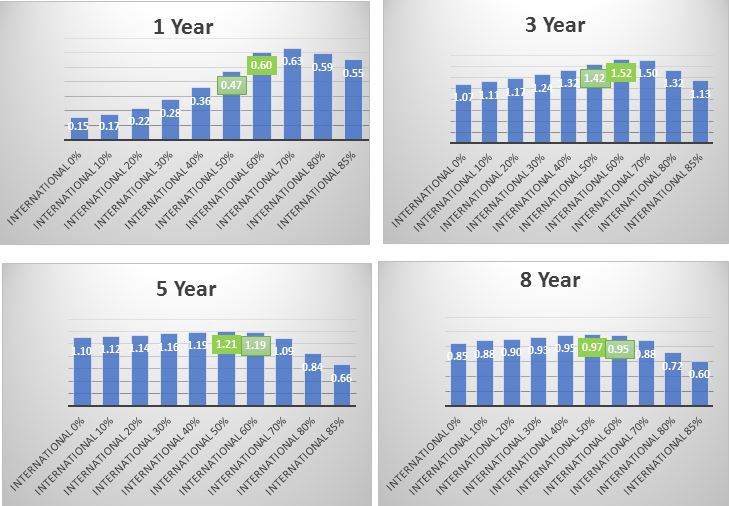

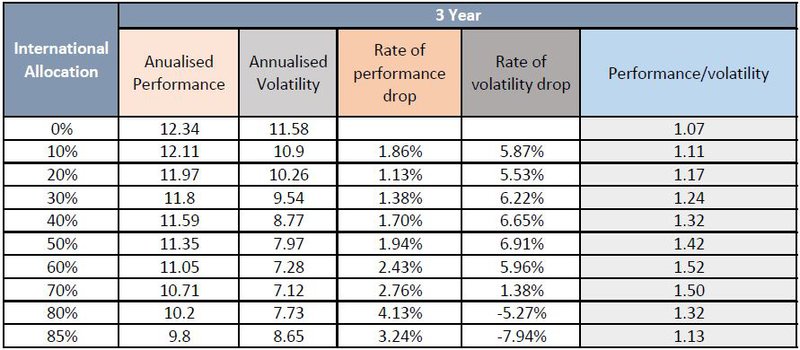

After preparing the portfolio, we found the Annualised Performance by Volatility of all the above-mentioned portfolio. To understand the average return earned on per unit of volatility or total risk. The Result was like this:

As we can observe that, even if we allocate 50% to 60% of our portfolio in the international mutual fund then also it’s average return earned on per unit of volatility is good. But our concern should not only be to decrease the Volatility of the portfolio, because if the allocation will go beyond 30% then it is harming the performance of our portfolio. Allocation in the international mutual fund should be done as per the investor's Goals, Risk appetite, Return expectation and Profile of the investor.

How to invest in international mutual funds?

Investors can invest in Feeder funds or international funds which invest in equities of a region or country or fixed income securities. As a resident Indian, you can invest in Indian rupees. Like any other mutual fund, you can select the fund, and invest in the same way you do for Domestic market mutual fund. The regulation for international mutual funds is the same as domestic mutual funds.

How are international funds taxed?

For a holding period of less than two years, the investor is required to pay short term capital gains tax on the profits at his/her tax slab. When the fund is held for more than two years, the gain is taxed at 12.5%.

Conclusion-

We have come to the conclusion that-

- An investor should diversify their portfolio geographically.

- SIP is one of the best ways to invest in an international mutual fund.

- International mutual fund reduces the risk of the portfolio.

- Allocation in an international mutual fund should not go beyond 30% of the total portfolio. However, this can vary according to the Goal and Risk profile of the investor. For example, for a child education goal abroad, one can choose more allocation to international mutual funds, whereas for own retirement goal allocation should be around 20%.