Real Estate Investment Trusts (REITs). A Viable Investment Option?

Traditionally,

investing in real estate in India meant buying a plot of land or a residential

property for personal use. Till the arrival of REITs, investment opportunities

in commercial real estate were rendered inaccessible for retail investors owing

to constraints posed by large ticket sizes (Rs. 1 Crore or more), illiquidity

in long term investments, hassles in getting timely clearances and difficulties

in managing sizable assets.

With the recent introduction of REITs in the Indian market, investors can invest and gain financial exposure to commercial real estate without having to physically purchase and manage properties themselves.

In this article, we examine the key characteristics of REITs as an investment product, analyze the benefits and drawbacks of investing in REITs and provide an assessment on whether REITs are a viable investment product.

What are REITs?

REITs are companies which own, operate and fund income generating real estate across various sectors. Some of these sectors include but are not limited to office spaces, residential properties, industrial facilities, and data centers.

Like a mutual fund, REITs raise capital by pooling investments from multiple investors and by issuing a proportionate number of units to investors in exchange for their investments. The pooled investments are utilized by REITs to finance real estate assets held in their respective portfolio and acquire new income generating properties. The properties managed by REITs generate rental income which is transferred to investors as dividends on a quarterly/ half yearly basis. In addition to earning a steady stream of income from dividend payouts, investors can reap the benefits of capital appreciation in property value without having to buy and manage any of the properties themselves.

Established in 1960 by the US Congress, REITs were introduced with the sole objective of providing smaller investors a feasible investment avenue to access and reap benefits from commercial real estate. Benefits which were previously accessible only by large financial institutions and wealthy individuals.

Since then, REITs have successfully evolved to become a well – established investment vehicle in the U.S with approximately 43% of American households owning units of REITs either directly or indirectly through mutual funds and ETFs ((NARIET,2021). At present, the success of REITs extends beyond the shores of the U.S to 40 nations which include members of the G-7 and the OECD (Organisation for Economic Co-operation and Development) that now have a REIT regime in place.

Types of REITs

Since its inception, the REIT model has been refined and enhanced, however its core objective of investor inclusivity remains the same. The REIT model can be classified into 2 categories:

- Equity REIT

- Mortgage REIT

Equity REIT

Equity REITs are the majority in today’s REIT market, offering investors access to diverse portfolios of real estate holdings. Equity REITs are responsible for owning, acquiring, managing, and financing real estate properties held in their portfolios. They lease their properties and generate income through rental collections and interest payments from their tenant base, a bulk of which is then transferred to investors as dividend payments on a quarterly or a half yearly basis. Equity REITs also generate income through the sale of properties.

Mortgage REIT (mREIT)

Unlike equity REITs, mREITs are fewer in number and do not own and manage real estate properties. mREITs are primarily responsible for injecting liquidity into the real estate market by investing in residential/ commercial mortgages and mortgage-backed securities (MBS). The interest earned on their investment is transferred to investors as dividends.

Entry of REITs in India

The REIT model achieved global success in cementing its reputation amongst investors as a credible investment avenue and in providing a platform for raising capital for real estate assets globally. With SEBI regulations in place, REITs finally made its entry in India with Embassy Office Parks publicly listing its REIT on 3rd April 2019.

Followed by the recent IPOs of Mindspace and Brookfield REIT there are currently 3 publicly listed Equity REITs on offer in India. All 3 REITs own and manage Grade A office properties across major Indian cities and are leased to large multinational and fortune 500 companies for lease periods spanning 6-8 years. With recent amendments to SEBI (REIT) Regulations, 2014, on June 29, 2021, investors can invest in these REITs at an investment range as low as INR 10,000-15,000.

REITs in India: SEBI Guidelines & Structural Framework

In India, for an organization to be legally qualified as a REIT it must adhere to the following guidelines mandated by SEBI (REIT) Regulations, 2014:

1. The company must have a minimum asset base worth Rs. 500 Crores.

2. 80% of its investment portfolio must be in completed and revenue generating properties whilst only 20% is permissible to be invested in properties under construction.

3. To own and manage properties through a Special Purpose Vehicle (SPV), the REIT must have a minimum ownership stake of 50% in that SPV.

4. Net Debt cannot exceed 49% of its total asset value.

5. 90% of its net distributable cash flows must be distributed to investors as dividends.

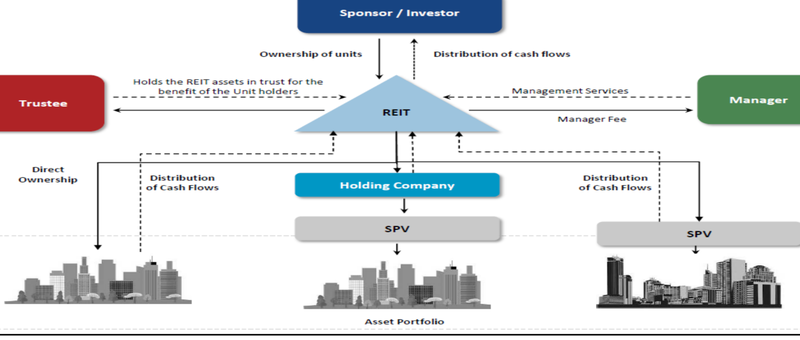

The structural framework of a REIT and the role of associated stakeholders is illustrated in the diagram below:

Source: HDFC Securities (2021)

The Sponsor is responsible for setting up a REIT and appointing a qualified Trustee. The Trustee oversees the activities of the REIT, ensures its compliance with SEBI norms, and protects investor interests. The Manager professionally manages the REIT portfolio. Upon pooling funds from investors, the REIT either directly invests the pooled funds into properties it owns or indirectly invests them by loaning funds to holding companies called Special Purpose Vehicles (SPV) in which the REIT has a partial or complete ownership stake.

The SPV utilizes the loaned funds for the management and upkeep of the properties and is responsible for collecting rental income from property occupants to be passed onto the Investor. Furthermore, the SPV pays interest at regular intervals on the loaned funds it receives from the REIT. The final payout which the Investor receives from the REIT comprises of a combination of rental income from tenants, interest payments from SPVs and repayment of debt by the SPVs.

Tax Treatment of REITs

1.Taxation on REIT Payouts

The tax treatment on the quarterly/ half yearly payouts which the REIT provides to its investor depends on the tax regime it has opted to abide by.

As stated in the previous section, the payout amount per unit of REIT which the investor receives comprises of 3 components:

ü Dividend (Rental income)

ü Interest Payment by the SPV

ü Debt/Capital repayment by the SPV

Interest payments are taxed at the slab rate applicable to the investor, whilst the debt/capital repayment is tax free. If the REIT has opted the old regime of corporate taxation, dividends are tax free. However, if the REIT has opted the new regime of corporate taxation, dividends will be taxed at the slab rate applicable to the investor.

2.Capital Gains Taxation on REITs

Capital gains arising from the sale of REIT units will be taxed as follows:

Short Term Capital Gains Tax: If units of REIT are sold prior to the completion of 3 years since its date of purchase, it will be taxed at a rate of 15% (including applicable surcharge and cess).

Long Term Capital Gains Tax: If units of REIT are sold 3 years after its date of purchase, capital gains exceeding Rs. 1 lakh will be taxed at a rate of 10%.

What do REITs offer?

1. An affordable and liquid investment alternative to physical real estate and AIFs:

With ticket sizes exceeding Rs. 1 crore, Real Estate AIFs in India are typically out of reach for the average retail investor. Similarly, investing in physical real estate also requires a sizable investment corpus, involves high transaction costs and is a highly illiquid asset class. As a publicly traded entity on the stock exchange with ticket sizes ranging as low as INR 10,000-15,00, REITs provide retail investors a liquid, affordable and a less cumbersome investment avenue to transact and gain exposure in professionally managed commercial real estate.

2. Attractive Rental Yields and a steady stream of income:

In India, residential properties have traditionally been a preferred investment avenue for savvy real estate investors. Despite its popularity, investments in residential properties in recent years have generated declining rental yields and have not shown much prospect in asset appreciation. Residential rental yields per annum have gradually stagnated in recent years with its national average currently standing at a mere 3%. Grade A office spaces on other hand offer relatively higher rental yields per annum ranging between 6-8%. Such high-end properties which were once out of reach for retail investors can now be affordably accessed through investments in REITs. By investing in REITs, retail investors not only benefit from higher returns from attractive rental yields but also from a steady stream of income secured through long term lease agreements with its tenant base spanning 6-8 years.

Are Investments in REITs Worthwhile?

REITs are a distinct asset class and generally have a low correlation with equity and bond markets. While the returns of REITs are comparable to debt products their risk profile is higher and akin to equity products. REIT prices and returns are influenced by market related supply & demand, evolving trends in the economic cycle, lease renewals and occupancy ratios.

Since the outbreak of the pandemic, occupancy ratios of both Mindspace and Embassy have sharply declined as some of their clientele deferred leasing while others exited their leases prematurely. This decline in occupancy coupled with rising levels of uncertainty in leasing activity adversely affected REIT prices and consequently impacted rental income distributed to investors. The emergence of the work from home culture could further suppress demand for office spaces and depress lease rental rates in the coming years.

In addition to risks posed by market volatility, RIETs are mandated to distribute 90% of their earnings to investors allowing for only 10% to be reinvested into their business ventures. Therefore, the lack of sufficient earnings for reinvestment may hinder the ability of REITs to achieve sustainable growth in the long term. Furthermore, the obligation to provide high investor payouts could pressurize REITs to excessively rely on leverage to fund its ventures which in turn could further exacerbate its risk profile.

REITs are viewed as investment products which can enable investors earn a higher rate of return than fixed income instruments and benefit from capital appreciation in property value. So far, returns from REITs have not been in line with their associated risks when compared to returns generated by risk free sovereign and AAA bonds.

In India REITs are priced to yield only 100-150 basis points above its benchmark government bonds, while in international markets, such as in the US, UK, Singapore and Hong Kong, REITs yield returns which are 400-600 basis above their respective sovereign bonds pricing in the risks. Investors expect a higher rate of return for the underlying risks involved in their investments. REITs in India however do not adequately compensate investors for the risks they bear when compared to REITs abroad.

As REITs have low correlation with debt and equity, it is commonly postulated that REITs can offer benefits of asset diversification in a multi asset portfolio. However, the 3 listed REITs at present do not offer diversified portfolios as it primarily invests in a single sector, Grade A Office Space. Therefore, by investing solely in 1 sector, investors bear undue risks posed by systemic market volatility which cannot be diversified away and could significantly harm the sector.

To benefit from diversification, investors should consider parking their investments in a REIT fund that holds diverse properties across a variety of real estate sectors. Kotak REIT FOF is a prime example of such a fund which offers exposure to multiple real estate sectors across various countries in the Asia Pacific region. Furthermore, investors should consider investing in suitable mutual funds and ETFs which have a sizable exposure in REITs. By investing in such funds, investors can benefit from the professional expertise of fund managers who can proficiently manage their exposure and investment in REITs as per market conditions.