ESG Investing Scenario in India

Over the past few years, there’s been an increasing trend of sustainable investing around the globe, which talks about non-financial considerations like Environmental (E), Social (S) & Governance (G) – ESG. Though the factors are non-financial, they are said to have relevance to company finance in the long term. This might include how businesses respond to climatic issues, resource management, internal policies for workers, innovative corporate culture, etc.

There is no doubt that the demand from investors for ESG investing has increased dramatically and become a need of the hour. But, should we consider these ESG schemes looking at current guidelines and disclosures? Or, are they a unique proposition from existing equity schemes? Should these be a part of our portfolio?

This article aims to answer some of such questions which arise while considering ESG as an investment category.

Source - Softexpert.com

ESG word originated from a study of “Who cares Wins” in 2005. Since then, assets have surpassed $35 trillion, globally as per Bloomberg Intelligence. Also, the COVID-19 pandemic & target of achieving zero carbon emissions by 2050 has given a boost to ESG investing. In contrast, India’s ESG fund AUM is Rs. 12,320 crores as of November 2021, which is 4 times up since 2019. However, this is just 0.3% of the total MF industry AUM of 38 lakh crore.

Indian Scenario Vis-à-vis Global

India has 10 domestic ESG funds as of 2021, out of which 8 funds have launched in the last year because of the pandemic hit, which shows a shift to profitability with no cost to sustainable growth. However, this comes out to be a very low number as compared to the global schemes of more than 3000. Not just this, India ranks 120th out of 165 countries when it comes to sustainability, as per the UN sustainability report of 2021.

Also, India doesn’t have a long history of ESG funds disclosures and regulations. This is now that the SEBI has come up with the proposal to invest only in the companies with the Business Responsibility and Sustainability Report (BRSR) disclosures, because of the increased demand seen not only by the FIIs but also the retail investors in the country. Still, there are no uniform norms and standards for ESG companies’ classifications globally.

Currently, Indian AMCs use their expertise to classify the funds as ESG complaints with the use of some external rating agencies' data and the ESG scores published by them. ESG scores are the numerical values assigned to the performance of companies on the parameters of environmental, social, and governance factors.

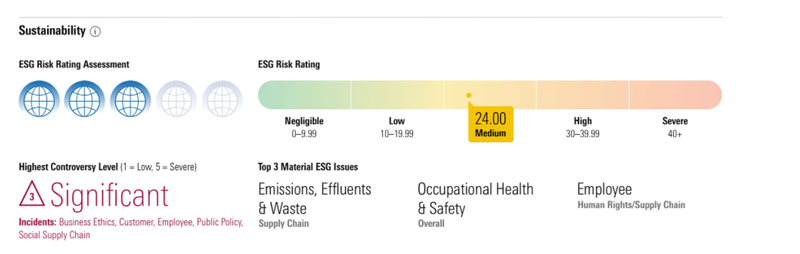

An illustration is shown below of ESG Risk Scores for companies by Morningstar. This is readily available on the Morningstar website on stock quote pages, under the tab of "Sustainability". A 5-Global rating means the company has significant ESG risk and a 1-global rating signifies negligible risk. Also, the top 3 ESG issues are identified for each company.

Source- Morningstar.com

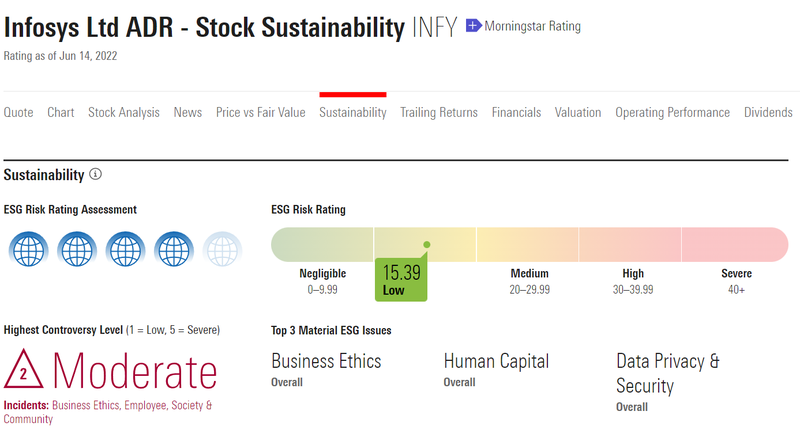

However, assigning the scores is not that simple. It comes with too many complications and confusion because of the non-clarity of ESG parameters. For example, IT companies may be rated 2 i.e., low ESG risk mainly due to the practice of generating fewer carbon emissions or almost no carbon emissions. This makes them environment friendly but on the other hand, these companies are currently under inspection for their policies related to data privacy which makes them non-compliant on the part of the social factor of ESG as shown in the image below.

Source: https://www.morningstar.com/stocks/xnys/infy/sustainability

Many other examples can be stated regarding third-party tie-ups for raw materials and other services. An ESG-compliant company has to source materials from the companies against whom significant concerns are raised in regards to the harm to the environment or the health and safety of workers. In these cases, it becomes difficult to find all the three ESG factors together and assign ESG scores to a company.

The question which arises here is – Are ESG funds distinctive from our normal equity MF schemes and should these be constituted part of our portfolio?

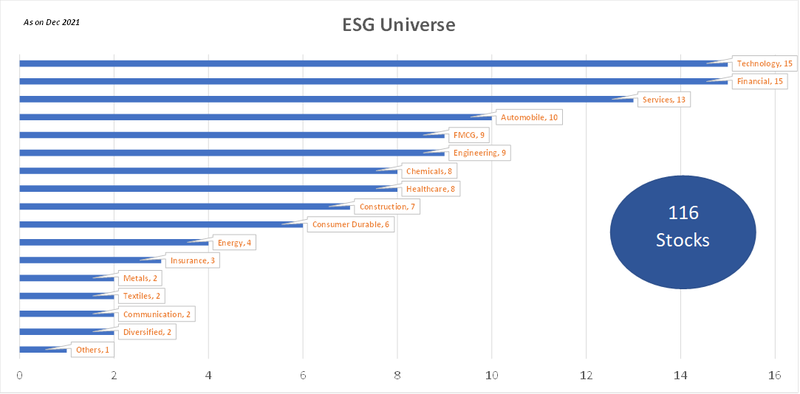

Source – Value Research

The figure above shows the analysis of domestic MF schemes’ portfolio (sector-wise) of ESG funds. It can be seen that there are in total 116 stocks that constitute the ESG Universe in Indian MFs. Looks like a quite broader selection due to the non-uniform and non-standardization nature of ESG classifications. This is the major problem which is faced worldwide. Although, in 2020 there have been some disclosures to address this issue, the same will take time to accept and would require amendments over time for the improvement for the betterment of investors.

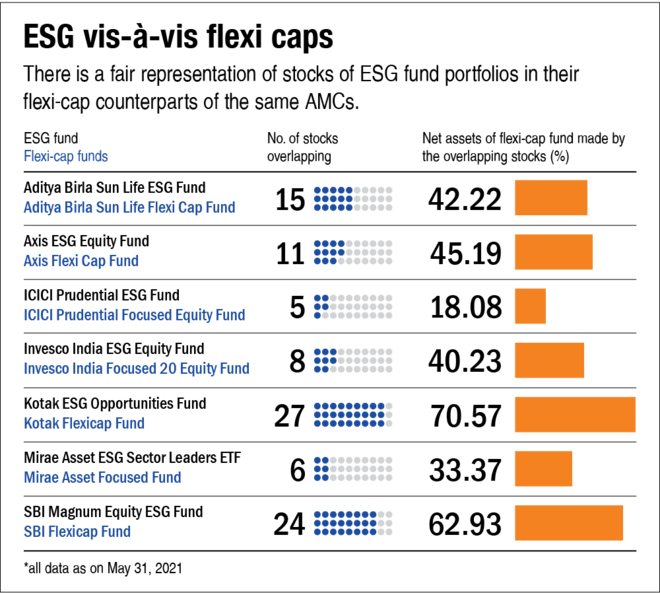

Also, an analysis was done by Value Research in May 2021 – “ESG vis-à-vis Flexi caps”. It compared the underlying portfolios of the few ESG funds available in India with those Flexi cap funds which same fund houses offer. What they found was some overlap between the stock portfolios of ESG funds versus the Flexi cap funds as shown below figure. The conclusion they made here is that, while investing in the Flexi cap funds, investors are already getting exposure to the ESG factors in their portfolios.

Source – Value Research

The above figure states that the overlapping of stocks ranges from 6-27 and the net assets of Flexi cap fund made by the overlapping of stocks varied from 18% to a significant 70%.

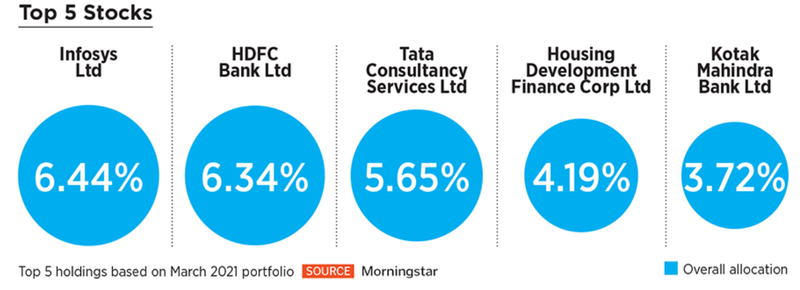

The top 5 overlapping stocks of ESG funds which can also be seen easily as part of 50+ Flexi cap funds are Infosys Ltd, HDFC Bank Ltd, TCS, HDFC & Kotak Mahindra Bank Ltd.

Performance of Thematic – ESG as a Category

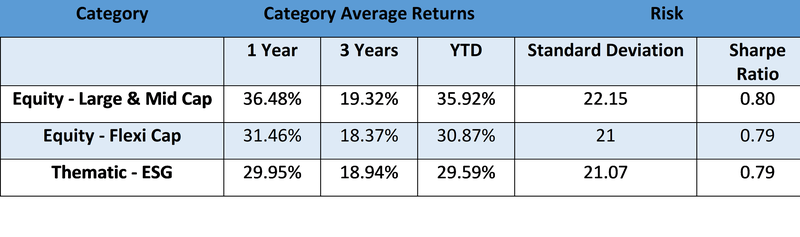

Since the primary objective of investments is to enjoy the returns at the end of the period vis-à-vis the risks taken, it’s become imperative to have a look at the performance of ESG as a category. As ESG's major portfolio constitutes Large & Mid Cap stocks, a category average return compared with the risk-reward is stated below in the table.

Source – Economic times (https://economictimes.indiatimes.com/marketstats) & Value Research

The above table shows that the category average returns of ESG funds have been on par or less than the category averages of Large & Mid Cap and Flexi cap categories across 1 year, 3 years & since the inception period. The risk return-reward is also slightly lower for the ESG category.

Conclusion

ESG as a concept highlights investing in the stocks or funds which is a true picture of sustainable growth which can have a positive long-term effect on the profitability of businesses as a whole. Thus, may have a better risk-return reward in the future. After all, everybody wants to leave behind a better world for their future generations to live in. This particular thought and everybody’s interest might outperform the ESG Categories as investments as compared to other equity funds categories in the long term, BUT, subject to the proper disclosures, frameworks, and regulations.

So, overall, it takes us to the conclusion that, in India, there is first a need for voluntary disclosures on part of companies than compulsory disclosures. The BRSR regulation is a good move, but SEBI will soon need to do more, mandate and define what constitutes an ESG fund.

Covid-19 has been an inflection point for ESG funds, but it will take a long time before India attains maturity in reporting, evaluating and demanding accountability for sustainable business practice. Till that time, it’s better to watch the trend and continue to invest in diversified funds which already give exposure to ESG stocks & a better risk-return reward.

-Shrikant